Are Branded Residences worth paying a premium?

Marketing Branded Residences

Branded watches like Rolex command a price premium because of their perceived scarcity value. As a result of this constrained supply of new watches there has been an absolute explosion of prices on the resale market where some Rolex watches now command far higher prices used than they do at the retail counter. For example, a steel Daytona is advertised on the Rolex website for US$13,150, but over at Chrono24 the exact same watch is listed for more than US$36,000.

But are Branded Residences in KL worth paying a premium of over RM1000 to RM2000+ psf over other high end KL properties without a “brand” name? According to Knight Frank, there are more than 400 Branded Residences worldwide. In Malaysia, there are four completed hotel branded residences — Four Seasons Private Residences Kuala Lumpur, The Ritz-Carlton Residences, The Residences at St Regis Kuala Lumpur and Banyan Tree Signatures Pavilion. According to Knight Frank, future supply includes YOO8 @ 8 Conlay, Ascott Star Residences and So Sofitel Hotel & Residences, which will be completed between 2020 and 2023.

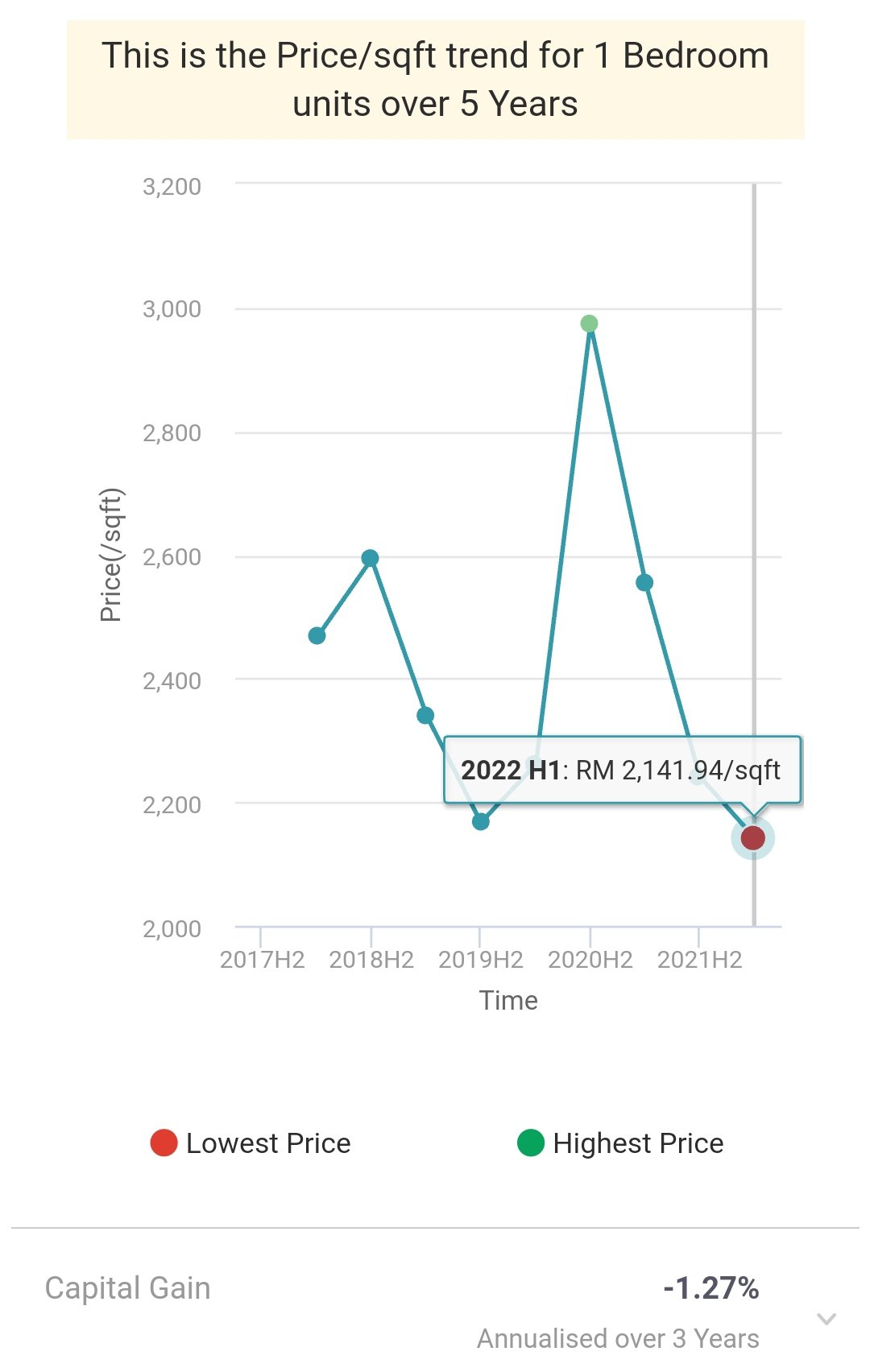

Using PropertyGuru's “Pricing Insights” a new feature that shows line charts of property transactions price by bedroom size, I found that 4 bedroom units at Ritz-Carlton Residences have bucked the general trend by showing a price appreciation to about RM3400 psf in 2022. In contrast smaller units like the one and two bedroom units at the Ritz-Carlton Residences have seem transactions prices in PSF falling to RM2100 and RM2200 respectively in 2022. See charts below.

Presumably, demand for the 4 bedroom units at Ritz-Carlton is greater because they are on higher floors and therefore command better views of KLCC's iconic Twin Towers and KLCC Park. Rina Zaaba, a PEA and Division Director at KW Reapfiekd who is a KLCC /Branded Residences specialist noted there are only 16 four bedroom units @Ritz-Carlton Residences. Of these, she says 12 have good views of the PTT and park.

See also my posts at 360 KLCC on whether properties near national icons, shopping centres, malls or with views of parks and greenery command price premiums over those without.

I also looked at historic property transactions price PSF charts for selected 5* KLCC condominiums while doing research for a post on whether High End KL Condominiums are inflation hedging assets.

Here is the PropertyGuru Pricing Insights line chart for four bedroom units at Kirana Residence. See below.

A 4 bedroom Kirana Residence unit was up for auction in May for RM3 million (RM779 PSF). Do you think 4 bedroom Ritz-Carlton Residences units are worth more than 4x the 4 bedroom units at Kirana Residence?