4 tips on how to boost your social media profile -Part 1/4

Piggyback on a Market Leader

Knight Frank Malaysia is a full service local estate agency that is affiliated to an international network of real estate agents. I follow KF on LinkedIn because their real estate agents have really mastered the “Art of the Soft Sell” on social media marketing eg LinkedIn. KF's marketing messages are very cleverly written to showcase USPs of the firm (eg. the professional experience of their agents ) or the properties being marketed (eg 3 reasons why we like this 5” condo) . I think KF has a very good in-house graphics designer - their social media content is usually accompanied by a nice colorful infographic, chart or illustration.

So WHY spend hours creating original content when you can piggyback on other people's content? I want to make it clear that you should NOT do a cut & paste job. WHAT I mean is you should attach your original comments based of course on your years of experience, either to amplify KF's points or you provide a completely different take on the SAME points.

Here is an example of how I piggyback on a recent KF LinkedIn post “Is it the right time (to buy properties)’. See below. KF in its introduction offers to help property owners find out how much a property is worth and get advice on the best time to buy or sell from “our experts at Knight Frank”. That is a good “soft sell”.

Here is how I do a Piggyback :

First, I politely disagreed with KF (I assume KF being a rea estate agency thinks it is the Right Time to buy property now 😁). Then I insert a URL link to my blog where I give 5 reasons why I think it is NOT the right time to buy HIGH END KL properties. Of course, KF might be correct now is the time to buy landed properties below RM500,000.

Then I give MORE considerations by inserting another URL on how to find out a property's estimated CMV (Current Market Value), it's USPs (unique selling propositions), Walkability Score, and where to find 5 year charts from PropertyGuru for transactions prices in PSF and Rentals in PSF for the property OR if not available (eg it's a New Projects property) similar properties of the same price and quality in the neighborhood.

In stockbroking parlance that is called my “Value Added”. It demonstrates my professional expertise and my 20+ years experience as a high end property investor. Note I am careful not to disparage any one's professional opinion -after all who knows if they are right and yours truly is wrong. But I take care that my points for disagreeing are rational and “reasonable”. Some more examples of Piggyback below:

And here are screenshots of the views I got as reported by LinkedIn's algorithm.

More than 1400 views !

And here is my Value Added introduction in my LinkedIn repost of KF's original post:

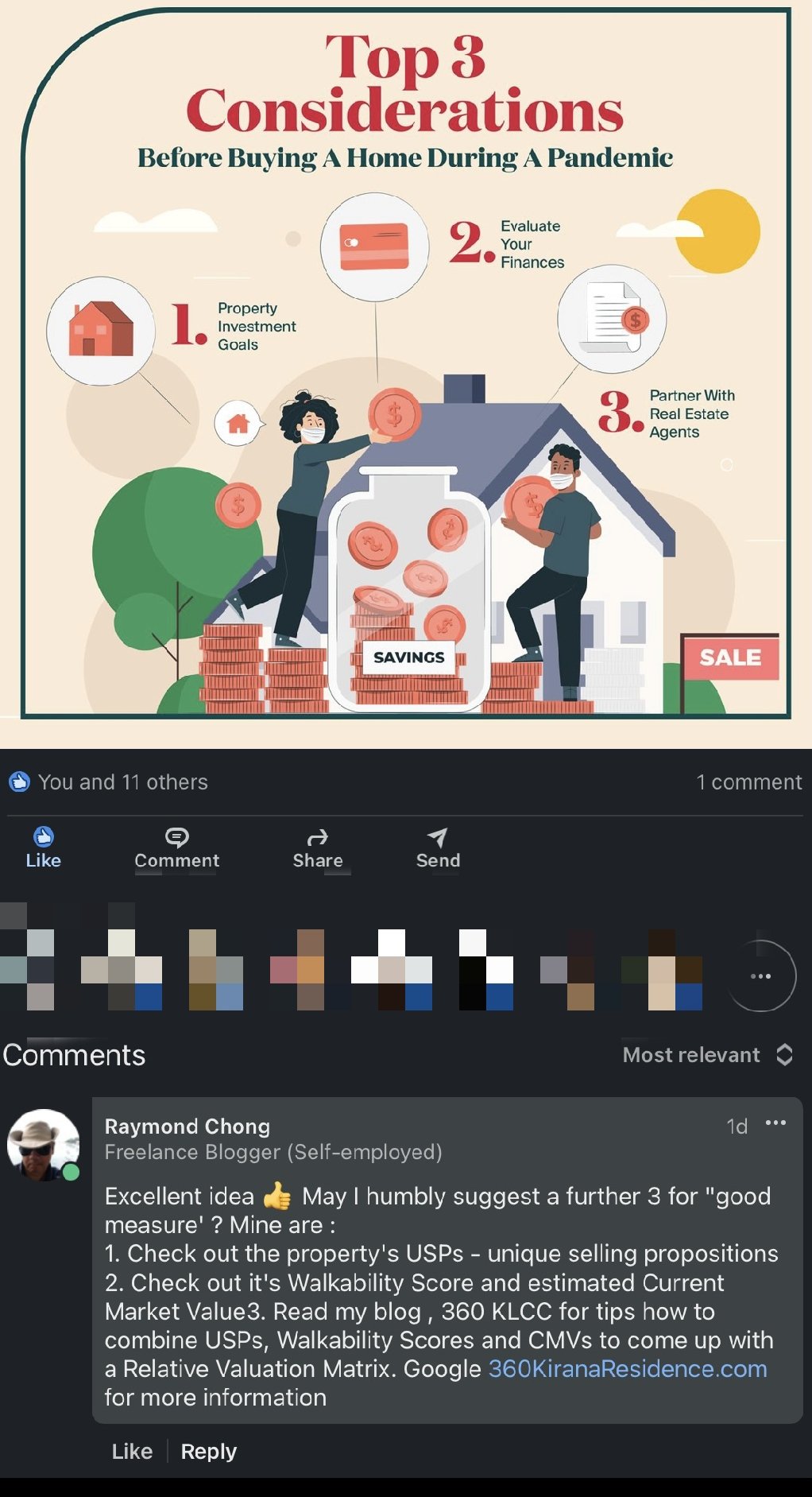

Yours truly endorses 101% KF Malaysia's 3 considerations for prospective buyers before buying property in the current economic climate. See below.

And may I humbly add 3 more considerations for good measure?

1. Learn how to identify property USPs (Unique Selling Propositions) on your own. According to one property expert I follow on YouTube & Tik Tok, if you can find out the USPs of any property you are interested in, you will be less likely to be taken in by the marketing spiel employed by developers https://lnkd.in/gjP57yyB

2. Learn how to use the FREE financial toolkits available from online property portals to get estimated CMVs (current market values) eg. EdgeProp Analytics and PropertyGuru's Vantage products. https://lnkd.in/gz9FCNHc

To see samples of EdgeProp Analytics' reports of Kirana Residence, a KLCC Luxury Condominium click here https://lnkd.in/gCH6YP4u

3. Read my property blog, 360 KLCC https://lnkd.in/gBAvh66n An example of what I blog on : Are properties near KL parks and greenery worth more? In other words, is there a "KLCC Parks effect" on transaction prices in PSF where a property's proximity to a park or patch of greenery results in a price premium?

Check out my 360 KLCC blog to find out…

PS a lot of real estate agents do.😜🤠

Disclaimer

1. I am not paid by KF Malaysia, EdgeProp or PropertyGuru to promote their real estate agency or consulting services.

2. I am not a registered investment advisor in Malaysia. My last IA licence in another jurisdiction expired circa 2001. My property blogs are based on my experience gleaned from my 20+ years as a high end KLCC property investor, plus membership of several KLCC MC and JMB commitees.

3.If you are considering buying an investment property, contact a BOVEA registered Valuer or Real Estate Agent for professional advice.

4. I have owned a 3000+SF unit at Kirana Residence since 2000. I have also served on the Kirana MC. My other blog posts comparing Kirana Residence -in 1999, along with the 3 Kia Peng Kirana represented the cutting edge of luxury living in KL -are here :https://lnkd.in/g2Yqmsvm

https://lnkd.in/gwJ4EGfP