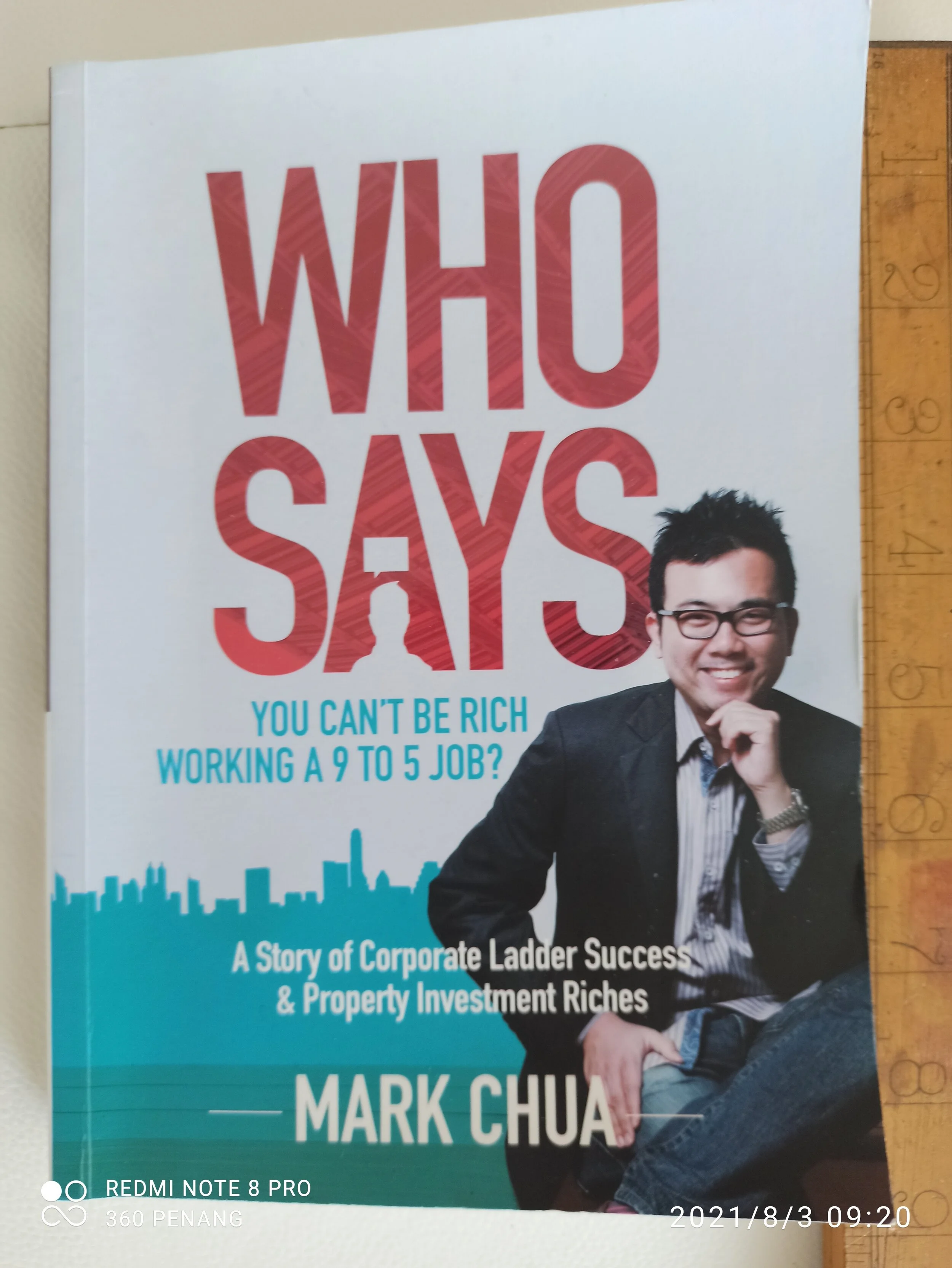

Book Review -”Who Says You Can’t Be Rich Working a 9-5 Job?”

I met Mark Chua , the author of Who Says at a Star Property event in KL back in 2017, I think. He was a featured speaker and had recently written a book on how he managed to amass a property investment portfolio while holding down a corporate sector job. Mark works in the financial sector in very senior management roles . I had a peek at his impressive online CV. Turns out he had a short stint at the same Red Dot Island bank that employed me as a junior flunky in their IBD (Investment Banking Department) many many moons ago. Small world indeed.

His 2016 book “Who Says You Can’t Be Rich Working A 9 to 5 Job” is well written and charts his investment journey in parallel with his quick rise up the corporate ladder. Chapter headings eg “The Junior Exec” to “The Senior VP” proffer sound advice on how to build a property investment portfolio as well as “dealing with A**H*** and Difficult People” along the way.

In the book cover, Mark mentions he achieved his goal of reaching the position of SVP in his bank by the age of 33. Coincidentally, the SVP I reported to as a fresh off the boat intern in the Corporate Finance dept of the Red Dot Island bank was around that age. But young as he was, SN had tremendous drive and confidence. He was the youngest SVP in this Red Dot Island bank and had overall responsibility to run the bank’s Corporate Finance, Investment Management and Nominee and Custodian Services departments.

The corporate culture in this particular Red Dot Island bank back in the 1980s was informal. Juniors were encouraged to address VPs, SVPs and even EVPs by their first names. No ties were worn by the guys except when visiting clients or when attending EXCO meetings with the top brass of EVPs and SVPs.

The EXCO meetings were chaired by the bank’s CEO and President, an urbane Singaporean with a British accent whom you were even “encouraged” to call Patrick, his first name.

Looking back more than 30 years later I think it was a probably a trap. Those foolish enough to call their President and CEO by his first name surely would have been marked for early termination.

As a wet behind the years intern at IBD I must have made a lot of mistakes but I certainly didn’t call him Patrick when it was my turn to present a paper before him at EXCO. You might shake your head in disbelief that back in the 80s, even fresh off the boat IBD interns at this Red Dot Island bank were given the opportunity to go to EXCO.

More than 30 years after I left employment at that Red Dot Island bank, it has grown into a global bank through a series of overseas acquisitions in the 1980s-1990s. My career in finance has been nicely bookended by chance interactions with this Red Dot Island bank. Four years in the bank’s IBD in the 1980s provided me with the opportunity to make a lateral move into stockbroking research first in Red Dot Island, then in another Asian financial centre.

But in 2000, the bank acquired a controlling stake in the retail banking business of X, the financial services group where I was employed. If my memory is correct, the bank offered X close to four times book value for the retail banking arm, almost at the top end of the market. It was much too good an offer to it’s Malaysian owners to turn down. But the loss of such a substantial customer base for the startup online business I was employed led indirectly to the end of my finance career with X.

As the saying goes, one door closes, another door opens.

Copyright by Mark Chua

I wish to thank Mark for the inspirational words he wrote in my copy of his book “ Be Who You Want To Be.” That’s very good advice for an old foggy . Also a personal disclosure : I am a member of #925 - a self help social enterprise that helps members achieve success in their careers, investments and relationships, of which Mark is a founder.