MM2H update @March 2022

Will Putrajaya's missteps over the MM2H Cha Cha Cha cost Malaysia billions of Ringgit ?

Yours truly has trawled the expat forums, watched countless YouTube videos made by expats and even managed to talk to one MM2H visa agency owner to try to understand why so many long-term expat residents on the MM2H visa program are now contemplating packing their bags. They feel unwanted by Putrajaya, disillusioned by policy U-turns, don't like the massive increases in FD deposits and cannot meet the new RM40,000 pm income requirements under the revamped MM2H 2.0 programme.

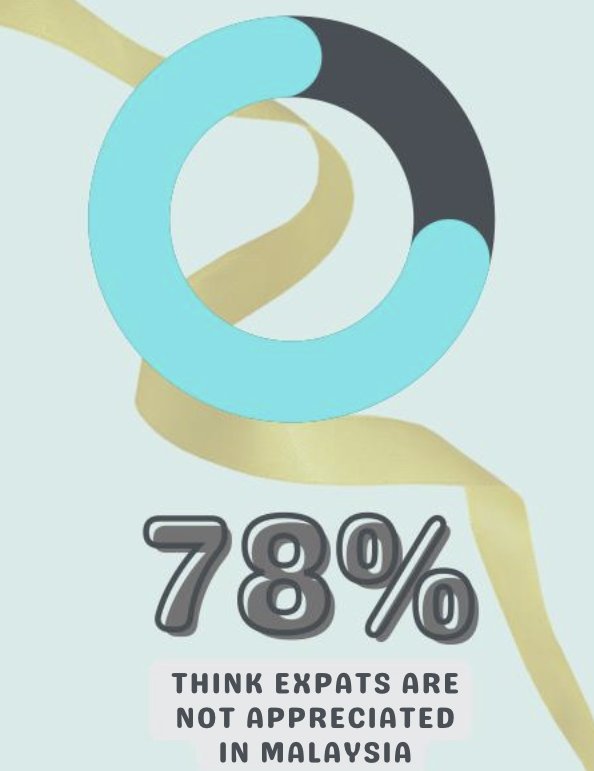

According to a 2022 survey of hundreds of expats currently on the MM2H visa and Resident Passes, many have become disillusioned and decided it's now time to bid "Selamat Tinggal Malaysia” (GOODBYE, in Malay). See here : https://en.calameo.com/read/00506399596af21d2f34f

Even if a majority of long-term expat residents bid Selamat Tinggal to Malaysia, property experts say the impact on the property market in Malaysia will be minimal. Mostly these experts point to the numbers of MM2H visa holders, make an estimate of how many expats on MM2H have bought actually bought property (about 10,000 principals on the MM2H visa program according to RHB Research) and come to the quick conclusion the economic impact of all these expats selling up on the Malaysian property market is just minimal.

For the record , I disagree with the sanguine prognosis. Let me try to explain exactly what I mean. The property experts are of course RIGHT on the overall numbers. But I am asking WHICH property market SEGMENT are the experts talking about?The Greater KL property market is of course NOT homogenous. For example, the micro KLCC rental market is dependent on a dwindling expat tenant pool . Unlike say the middle class Puchong property market that comprises mainly local tenants . Puchong rents have not quite been so badly affected by the pandemic.

I know that in 2021 -2022, the rents at some 5* KLCC condominiums have declined by 30-40% since 2018. (I rented a two bedroom apartment at the 29F of the 5* Platinum Suites in 2017-2028. The rent for that 1050sf apartment was RM4300 pm. For the current rent of a similar two bedroom apartment at Platinum Suites in 2022 click here)

Prospects for a rebound in the high end KLCC rental market do not look good to me in the Year of the Tiger. Why? Last year at my long term corporate tenant's request, I reduced the rent on my fully furnished 3000+ sf KLCC luxury condominium by RM500 to RM8,000 pm. On a inflation adjusted basis, my gross rent from my fully furnished high end property investment within 100 metres from KLCC Park is about 50% of what it fetched (partly furnished) when I got the keys from the developer in 2000.

Post Script

The Cha Cha Cha is a energetic Latin dance popular in the 60s where you take your (er, expat ?) partner two steps forward, twirl them to the right, then twirl them to the left before executing a 3 step turn back to your original position. 😉

In case any reader of this blog thinks rentals for my 3000+SF KLCC Luxury Condominium have declined because it is old and probably dilapidated, you might want to check out the pictures here.

When my 3000+sf Luxury Condominium was launched, it was the most expensive KLCC condominium (together with 3 Kia Peng) on the KL market. In fact, it was the cutting edge in Luxury Living in KL in 2000.

The RHB Research cited above does say “If at all, it should be only the high-end segment that will be affected, given the pricing threshold for foreigners to own properties in Malaysia. Based on Home Ministry figures, there are a total of 57,478 registered MM2H participants of which 28,249 people are principlas and the balance being dependents. Of the principals, only about 10,000 have bought assets in Malaysia.”