Whither The Greater KL Residential Market?

Zerin Properties 2Q 2022 GKL Residential Sector Insights

The property analysts at Zerin Research think,

“the Greater KL residential property market is stabilising with a general improved outlook for the economy albeit rising inflationary pressures. …

There are active bookings of rightly positioned residential products of reputable developers, particularly in city fringe locations, within TODs or near LRT and MRT stations. The location of new stations along the upcoming MRT line 3 (Circle Line) are highly anticipated by homebuyers and investors.”

🤠’s Dua Sen :

Well, maybe a nascent recovery is underway at the Puchong, Cheras or Kota Damansara property market segments - demand there is mainly by locals. Alas, I am not so sanguine about prospects for a bounce in the High End GKL property segment (highly dependent on foreign buyers and a dwindling expat tenant pool) in the near term.

High End KL Condo Market Prospects

Here are my 6 reasons that property investors should look at before concluding a nascent recovery in capital values and rentals in PSF is also underway at the high end KL property market.

1.There is a lot of supply coming on stream in the City Centre in 2H 2022 and 2023 according to Nawawi Tie Research and Knight Frank Malaysia. Part of the reason is that construction activities at many sites were shut down during MCO. Vacant Possession dates as a result got pushed back to 2H 2022 to 2023.

2. Vacancy rates in 5* KLCC condominiums remain high. I have not read a single Property Market report that mentions this key statistic - so is this the "elephant in the room" no property analyst wants to mention? But just take a look at PropertyGuru's Pricing Insights charts for rentals at the 5* KLCC condo of your choice to find out the recent trend. I think but cannot be 100 % sure that many KLCC condos show little signs of recovery in rentals PSF back to pre pandemic levels.

3. Buying interest by high end property investors is still lackluster. Just take a look at the number of KLCC auctions that have no bidders at their 2nd and 3rd auction outings.

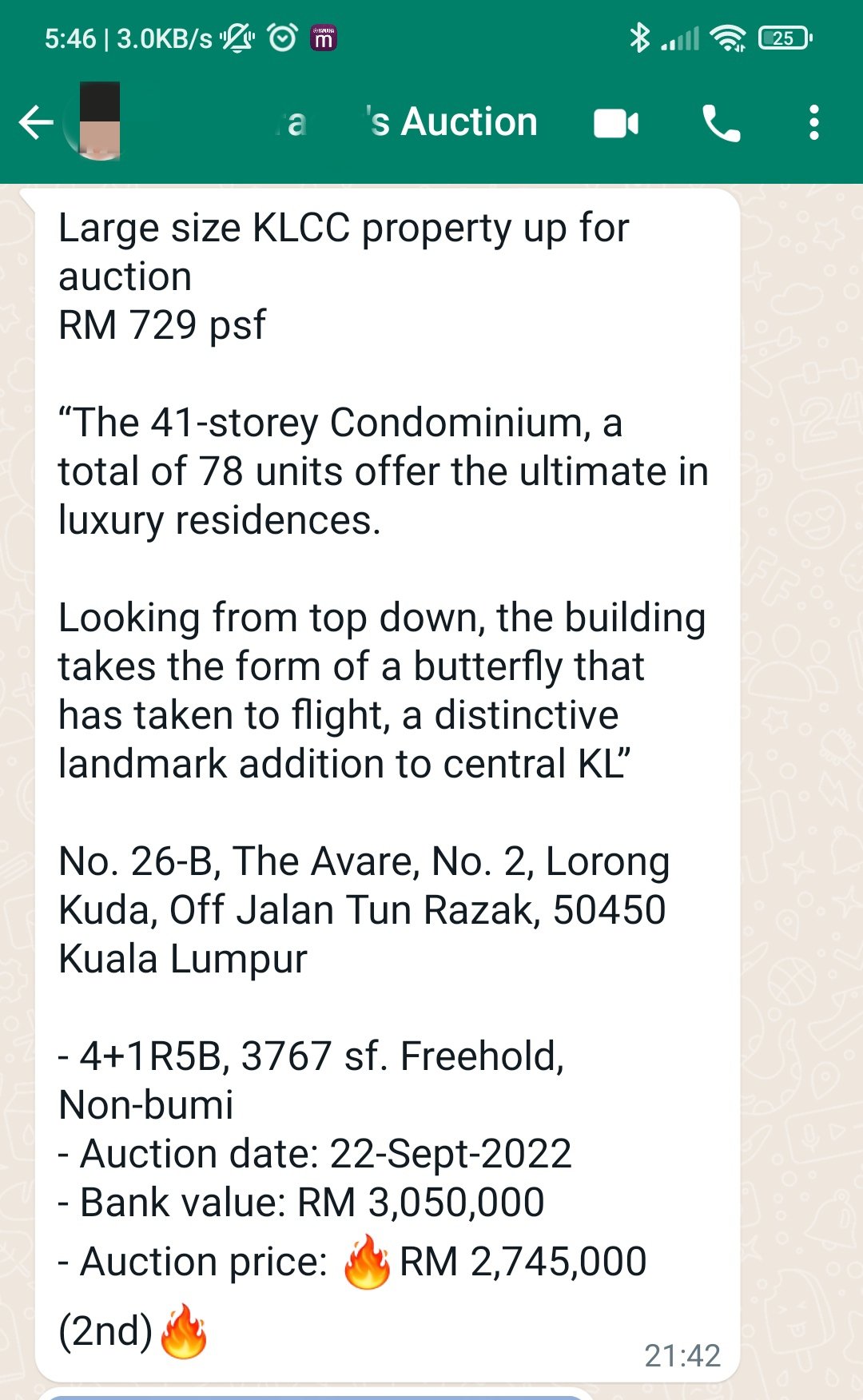

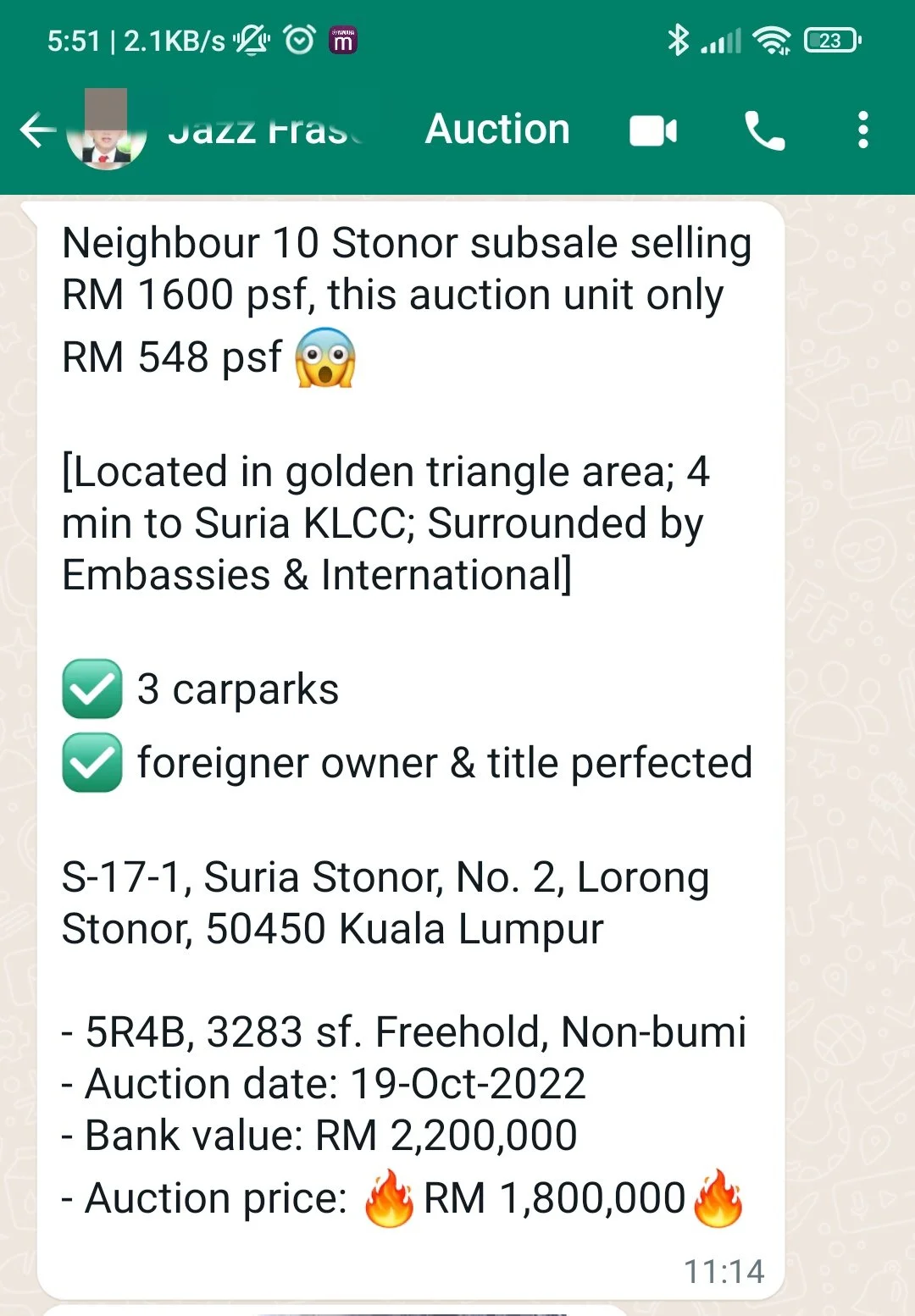

In KLCC, upcoming auctions of 5* luxury condominiums show a declining transactions property prices trend in PSF. For example a unit at Suria Stonor is going to the auction block at RM548 PSF . That's well BELOW its launch price of RM650 PSF in 2008.

A bigger unit (3767sf) at The Avare is going for its 2nd auction @ RM729 PSF this month. That's about 10% below its launch price in 2009. It will be interesting to see if there are any buyers on 22 September.

4. More interest rate hikes by Bank Negara are coming. Moody's Analytics is predicting a third 25 basis point hike in OPR in September.

5. The economic outlook for the US, the EEC and China is darkening. What's the worst case scenario for major economies like the US? Some market strategists like Michael Burry are calling a stock market crash is imminent because inflation has proven tougher to rein in. See my post at 360 KLCC, “Will Property & Stock Markets Crash in Malaysia?”

A growing housing crisis in China might lead to lower GDP growth next year. See also my post at 360 KLCC, “Will A Slowdown In China's Property Sector Affect Malaysia?”

6. The Ringgit's continued weakness. Fitch thinks Malaysia's 2022 growth outlook is hampered by weaker global prospects.

Post Script

I previously posted on whether homebuyers and investors will pay more for properties near LRT or MRT at 360 KLCC. For my conclusions and underlying reasons why KL is not Hong Kong or Red Dot Island where there are indeed price premiums for properties near MTR stations, see “Are Properties Near MRT Stations Worth More?” Part 1 Part 2

Avare and Suria Stonor units for auction

One KL 3 bedroom units rental PSF Source PropertyGuru's Pricing Insights charts

Troika 3 bedroom units for rent in PSF Source PropertyGuru's Pricing Insights charts

Suria Stonor 4 bedroom units for rent in PSF Source PropertyGuru's Pricing Insights charts