“Will A Slowdown In China's Property Sector Affect Malaysia?” Part 3/3

Al Jazeera Asks A Tough Question

China's property sector accounts for about 25% of its GDP. A recent post by Al Jazeera sums up the state of the Chinese housing crisis and spells out the economic spillover around the world if China's GDP growth falters, “As China’s property crisis grows, is the global economy at risk?”

If it does, will Malaysia's property sector be hit next year? (Chinese, Hong Kong and Red Dot Island property buyers account for a big chunk of demand for KL's branded serviced residences that can cost RM2500 PSF up. )

Uncompleted property projects now dot the cityscapes of China as it's building boom ends. Chinese property developers are facing a crunch because easy domestic credit is drying up, access to cheap offshore loans is getting harder and more costly, property prices are falling, and presales of New Projects properties are declining.

KPKT’s “Sick Developments” List

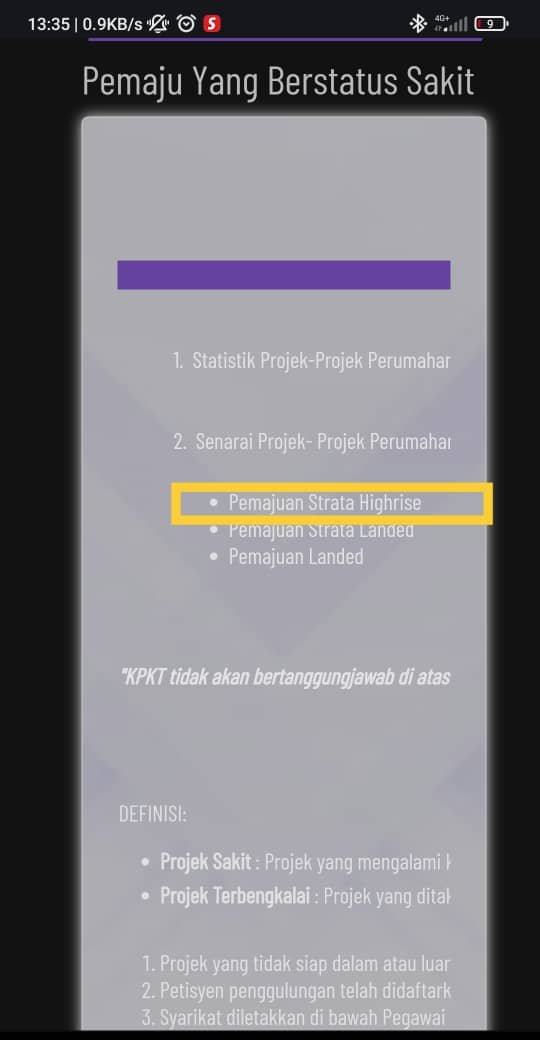

Over in Bolehland, one listed property developer has already slipped into PN17 as its auditor expressed a disclaimer on its FY22 financials. As cash strapped property developers in Bolehland face a Triple Whammy next year, will some be forced to stop construction work? The Ministry of Housing and Local Government maintains a list of property developers whose project completion are delayed, “Pemaju Yang Berstatus Sakit”. See figure below.

The presence of a property development project on the Ministry's list does NOT mean the project has been abandoned, merely the original VP date in the developer's original submission has been delayed. As an example, the New Projects property Quill Residences at Jalan Sultan Ismail appeared in the Ministry's list as at April 2022 with details such as the name of the developer, developer code, date of submission of development plans, and original VP date.

But in the updated August 2022 list available on the Ministry’s website, Quill Residences is no longer listed. A real estate agent to me explained the VP date for Quill Residences might now be as early as November this year.

In my other property blog I posted earlier how a very savvy Real Estate professional marketing Quill Residences used a social media platform and digital marketing techniques to create a sales funnel, present USPs and financials via Zoom, handled objections to buy via WhatsApp and follow up action to try to close a transaction.

Post Script

Please check out other posts at my blog 360 KLCC-"Analysis Insights & Perspective for the KL high end property market" :

Source : KPKT website , as at April 2022