“Will A Slowdown In China's Property Sector Affect Malaysia?” Part 1/3

Pushed to the brink

China's property sector makes up an estimated 25% of its GDP. Since July 2021, some big Chinese property developers have defaulted on their offshore bonds or had near misses. Chinese property developers are now facing a torrid time. Easy credit has been cut off, home prices are declining and some home buyers are not paying loan installments. The PRC government has capped developers’ ratios of liabilities to assets, net debt to equity, and cash to short-term debt (known as the “three red lines”). According to the Economist, these troubling developments have pushed China’s property sector to the brink.

If the property sector continues to crumble, it is going to have a big impact on China's economy. A major slowdown, in turn, would hamper a global economy already hobbled by soaring inflation and geopolitical clashes, thinks the Economist.

Since 2017, Malaysia has inched up to be the fifth favourite overseas destination by Chinese citizens to buy investment properties, according to IQI Juwai. In Bolehland, Chinese buyers tend to favour KL and Penang , picking up 5* seafront condominiums and luxury serviced residences. IQI Juwai expects Chinese buyers to gradually return to Malaysia to bargain hunt for properties in 2022 when borders are reopened.

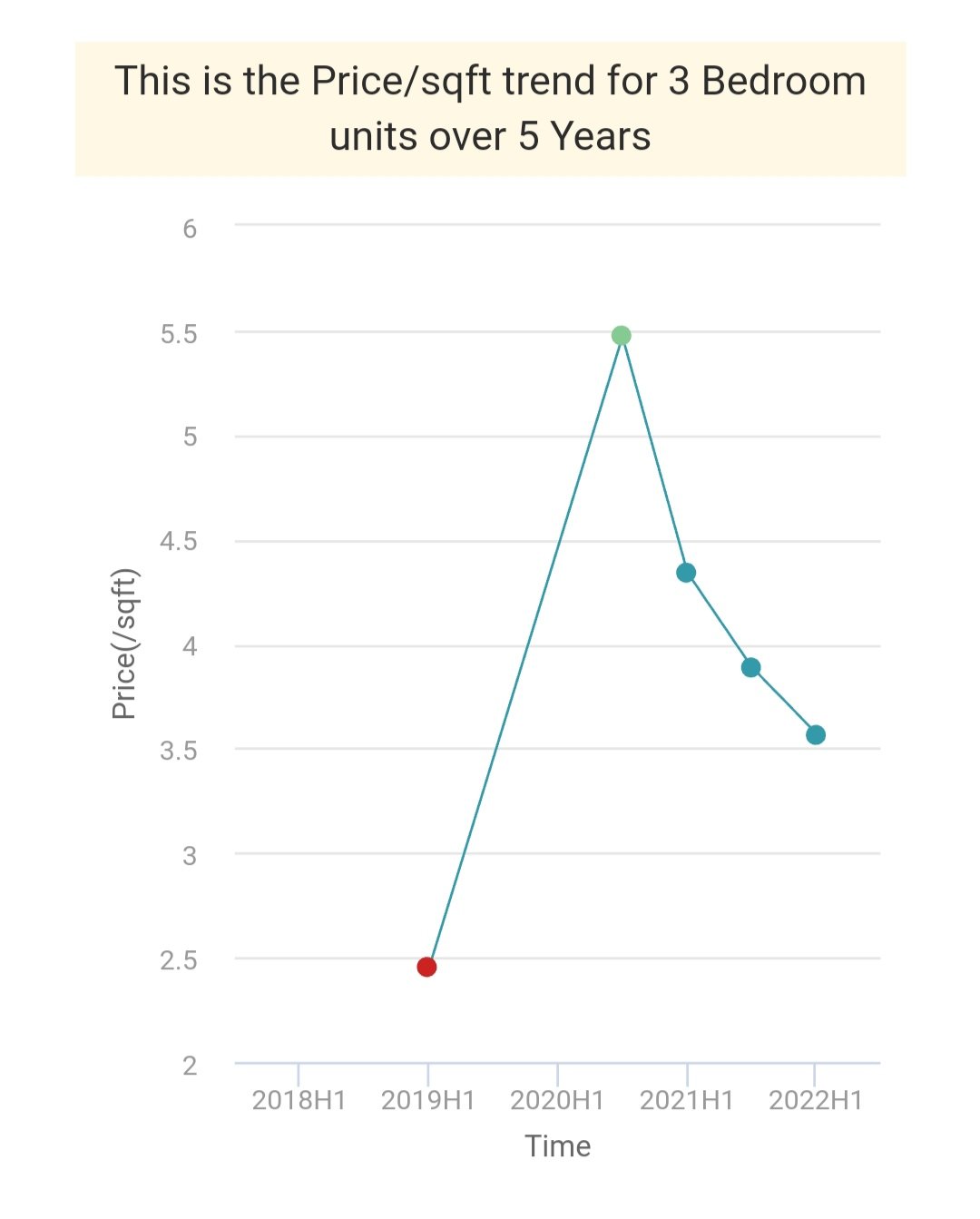

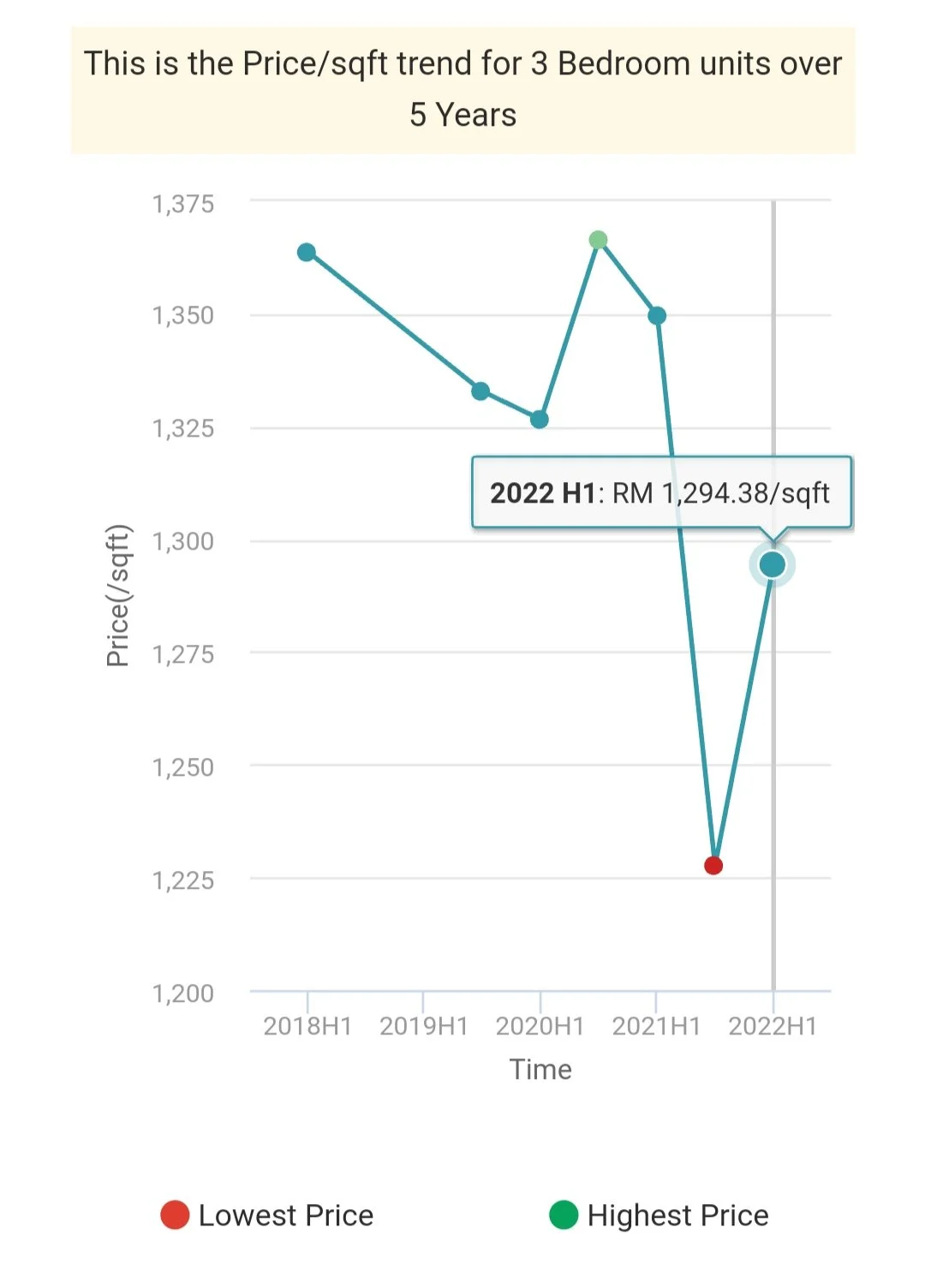

But in the aftermath of the pandemic, rentals for the type of luxurious properties favoured by Chinese property investors have declined sharply. Over the weekend I visited City of Dreams, a twin tower development of luxury serviced residences in Penang's Tanjung Tokong district. COD has about 600+ units and was completed in 2019. Although property transactions prices in PSF at COD have held up well, the rents for the fully furnished 3 bedroom apartments of around 1,000-1200sf have declined from about RM4,000 to just RM3,000 pm.

I think but cannot be 100% certain COD holds the National record of the serviced residence with the most number of amenities for residents (at a whopping 28). These facilities include a music room with its own baby grand piano, a Seniors room with Japanese style massage chairs, a Kid's playroom, a Teenagers’ playroom, equipped with gaming PCs, a bowling alley in house, snooker tables, a hair salon in house, a movie theatre, a cafe serving beverages, a Rolls Royce limousine for hire, a golf course simulator, and many more.

In my upcoming blog Waterfront View, I plan to review COD, and other seafront condominiums in Malaysia. In the pipeline are reviews for Quayside Seafront Resort Condominium, the Marin, Island Resort and The Meg at Andaman Island.

Straits Residences, a luxury serviced residence at Tanjung Tokong, was featured in my post about discovering an investment properties USPs.

See PropertyGuru's Pricing Insights charts for COD below.

Another luxury residence in KL favoured by Chinese and Singaporean buyers is 8 Conlay's YOO8 serviced by Kempinski Branded Residences Tower A and Tower B, now scheduled for completion in 2023 after delays caused by the MCO. Takeup rates as at 2022 were reportedly 80% and 40% for Towers A and B respectfully. The average prices for Tower A was reportedly RM3,395 PSF while Tower B prices averaged RM3,370 PSF. At above RM3,000 PSF the YOO8 towers are probably the highest priced Branded Serviced Residences in KL.

In Hong Kong there were 21 terminations of SPAs signed in 2020 for a single residential property project in Cheung Sha Wan recently, amongst the highest reported and a sign of a softening property market there. Given its combined total of more than 1,000 units, the two YOO8 Towers are clearly a benchmark of the top end luxury KL property market. If the take up rate for unsold YOO8 units is slower than expected, it means the KL high end property market is softening.

With falling rentals, higher interest rates in the offing and lackluster buying interest for high end KL properties (the proof is in declining auction prices for 5* and 4* KLCC auction properties) , I think but cannot be 100% sure developers in Bolehland are also heading for a Bear Property Market in 2023. Unless they have deep financial pockets, some developers might face a “Triple Whammy” next year:

Interest rates are projected to increase (resulting in higher funding costs for property developers),

Inflationary pressures have pushed up building material costs and labor inputs (resulting in shrinking development profit margins). Some property developers without price fluctuations clauses (Variation of Price clauses) in their contracts with their main contractors might find themselves in an invidious situation. If they decide to hold their main contractors to signed fixed price contracts, their main contractors might quit. Delays in finding a replacement on the other hand might lead to higher LAD expenses. So developers without VOP clauses might have to renegotiate terms with their existing main contractors, absorbing some of the increased building costs, albeit at the expense of lower profit margins.

Lacklustre housing loan demand by High End property buyers (the evidence is in the declining prices PSF in auctions of some KLCC luxury properties that have seen no buyers at 2nd, 3rd and even 4th auctions). When loan demand for mortgages fall, there is of course no fresh influx of home buyers to push property prices higher.

Property developers in Bolehland targeting Chinese buyers might soon have to come up with creative marketing solutions to unload their remaining inventory of unsold units. If there is a Bear Property Market next year, flush Chinese and Red Dot Island buyers might want to consider “Go Direct”, IE bypass the real estate agents and negotiate a 20% discount or more off the list price.

Post Script & Disclaimer

In 2000, when I bought my first KLCC condominium I asked the developer for a 15% discount off list price. I received a “special just for you” 10% discount. No agent required.

🤠’s Dua Sen : If you don’t ask for a big discount, you’ll never know if the developer is desperate to unload their unsold inventory.

Everyone thinks he/she is a good negotiator, yours truly 🤠 included. But with the benefit of 20+ years hindsight, I think but cannot be 100% sure the developer of Kirana Residence gave EVERY buyer a “special just for you” discount in 2000. Why? Property investment sentiment towards the KL high end condominium market was still fragile after the 1998 Asian financial crisis.

🤠’s Dua Sen: Deja Vu. 2023 is probably going to be another torrid year like 2000 for property developers without deep pockets (see “Triple Whammy for Developers?” and the Economist article “China scrambles to prevent property pandemonium “ here).

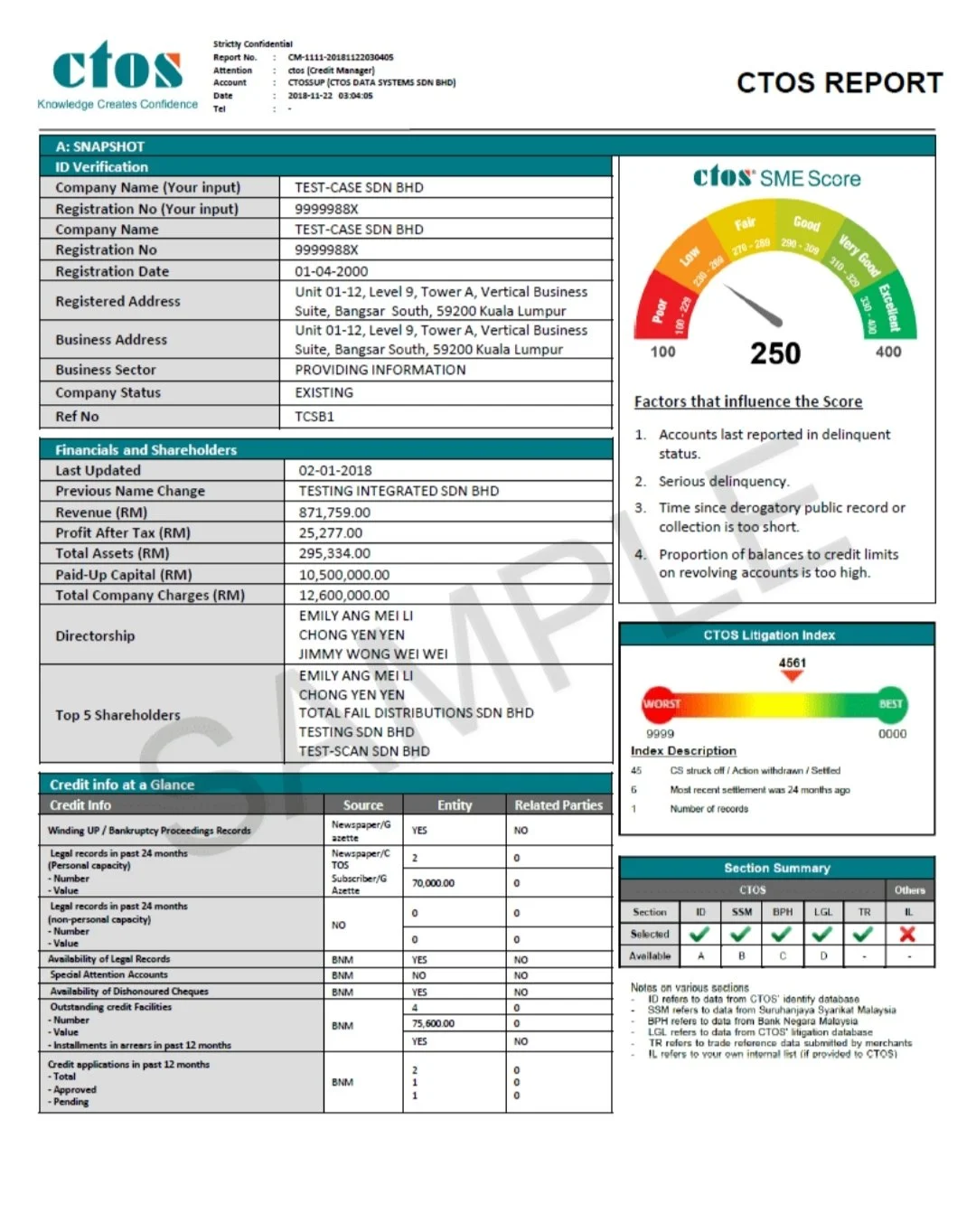

Ask to see the developers’s financial statements (if unlisted ask for a CTOS credit report that discloses who are the directors, bank borrowings (company charges), paid-up capital, revenue and profit and loss and the developer’s CTOS Score) For an example of a CTOS credit report summary see here or see sample for Test Case Sdn Bhd below. You have to pay to access the full report for an actual company.

I am not a registered real estate agent with the BOVEA. If you are thinking of buying an investment property in Malaysia you should consult a valuer or real estate agent registered with the BOVEA.

Copyright by KSK Land

Sample summary page of CTOS credit report and Sample CTOS Score for Test Case Sdn BHD. You have to pay to access the full report. Copyright by CTOS.