Property Rental Price, Demand & Supply Indices

Interactive Insights From PG Malaysia’s Q3 2022 Property Market Report (MPMR)

In a recent post to my blog 360 KLCC, “Is The Residential Property Market Really Recovering ? Part 3/3”, I mentioned the above quarterly property market report. PG’s Datasense has a novel Interactive chart. (By touching any part of the Red line representing the Asking Rentals Index, you obtain the corresponding index value - a very clever idea by PG Datasense)

Of the three line charts, I think only the Red line chart which represents the Index of Median Rentals for properties listed on PropertyGuru’s websites is the most useful. The Yellow and Blue line charts represents Demand and Supply Indices of rental listings on PropertyGuru’s websites. I think but cannot be 100% certain they have elements of double or even triple counting ( I assume PG Datasense’s counting algorithm does not differentiate between multiple listings by different agents for the SAME property)

PG Datasense’s objective -as far as I can see- is to track whether there is a nascent recovery in the property market. The underlying assumption I think but cannot be 100% certain is that Median Asking rentals are good predictors of Actual rentals in the future. I pointed out my reservations regarding the methodology of using Median Asking prices or rentals. I prefer to confirm a recovery in the property market by looking at the Actual property transaction prices and rentals achieved.

In another previous post at 360 KLCC, “Are KLCC condos near malls worth more?”, I took a deep dive into statistics by looking at the Median and questioned if more interesting insights can be gleaned by looking at the left hand and right hand distributions around the Median.

My high end property blog 360 KLCC as the title implies focuses only on the KL high end property market segment. I am not interested in the property markets in Puchong or Ulu Kelang or the other states of Bolehland. To cut a long story short, I and the readers of my 360 KLCC blog are interested only in whether Median Asking Rentals for high end properties are showing an uptrend.

I suspect the median asking property rentals for the KLCC market segment falls on the left hand distribution of the Median for all properties. Unlike other property markets in say Ulu Kelang or Kota Damansara , the KLCC rental market is dependent on a dwindling pool of expat tenants.

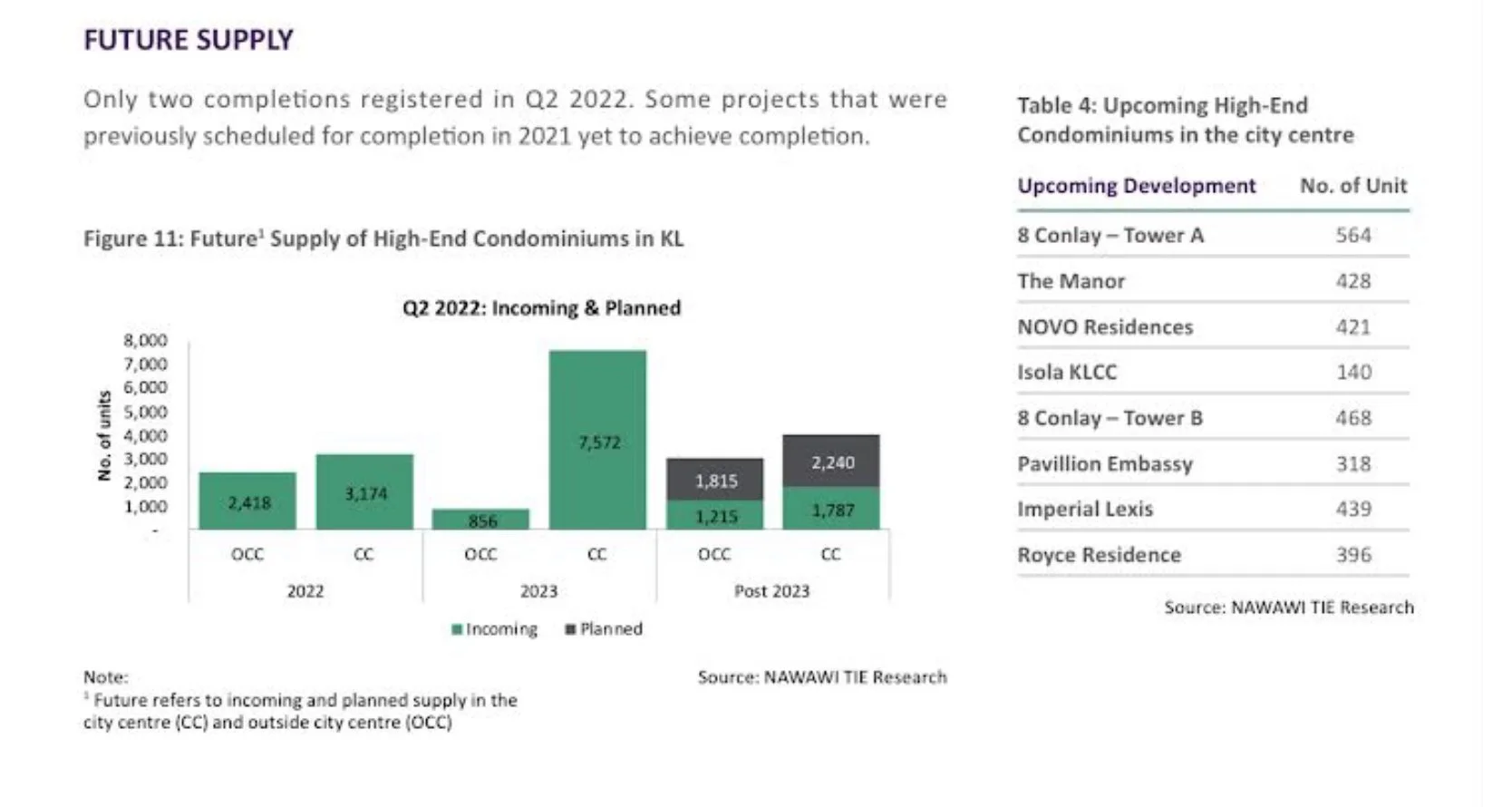

Copyright by Nawawi Tie. To download the entire report by Nawawi Tie see my blog post, “ Is the residential property market really recovering ?” Part 2/3

Two factors will weigh down any recovery in KLCC rentals in 2023:

the negative blowback over new MM2H rules (see “Latest MM2H figures prove the new rules are leading to a big loss for Malaysia”) and

a sharp increase in supply of properties deferred by the MCO in the KL city centre (more than 7500 units in 2023 compared to just 3200 units this year) according to Nawawi Tie. See the figure below :

Copyright by Nawawi Tie