Marketing Serviced Residences Part 2/2

Caveat Emptor

The news headlines from BBC say it all- “China Evergrande: Crisis-hit property giant faces deadline after bosses quit”.

As I mentioned in a previous 360 KLCC post Chinese property developers are facing a torrid time as easy credit dries up and the imposition of higher solvency ratios (the so called “3 red lines”, IE ceilings on the amounts they can borrow). China EverGrande is not the only developer facing a crisis. Other Chinese property developers are cutting prices to access cash to stay afloat. For more information how the the slowdown in the property sector might impact the Chinese economy, see the Financial Times, “China EverGrande : The End of China's Property Boom”

Over here in Bolehland, property developers without deep financial pockets will soon face a Triple Whammy due to a “Perfect Storm” :

rising interest rates (resulting in greater financing costs,

higher building materials costs (due to inflationary pressures worldwide) and

a drop in housing mortgage demand (leading to fewer buyers for their unsold inventory).

In Bolehland, industry sources estimate around 23% of property projects are currently facing delays in delivery of homes to buyers. Because of the MCO and the departure of construction workers back to their home countries, many construction sites stopped work. With the ending of MCO, construction activities have since restarted. But some developers are reportedly facing problems hiring enough skilled construction workers from Indonesia. In the worst cases, some property projects have been abandoned by their developers because there is no money to complete them.

In this connection, first time home buyers (FTHBs) should be aware of the risks of buying New Projects properties (uncompleted properties still under construction). See Post Script & Disclaimer. Many property developers are listed companies. So their financial statements are available to the public because financial statements must published regularly. But what if the developer is a private company?

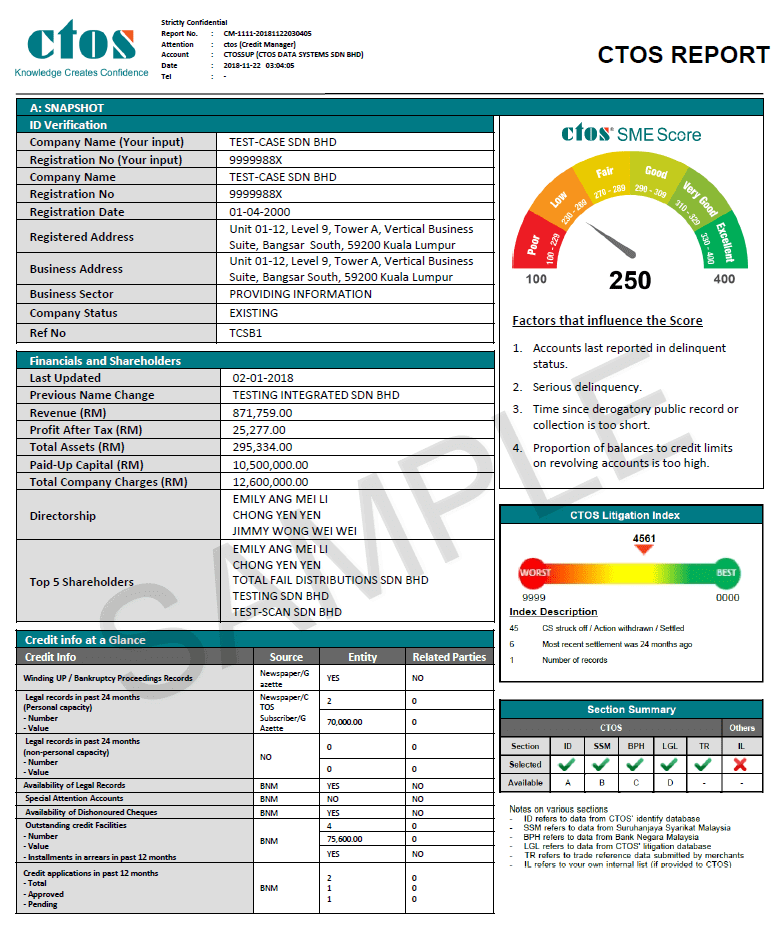

🤠's Dua Sen: If the developer is a private company, ask for a CTOS credit report on the developer. A fee is required of course to access the full CTOS report but at least you will get to know if the developer is currently solvent, who the directors are, bank charges, paid up capital etc.

It is beyond the scope of this blog post to discuss appropriate solvency ratios for Malaysian property developers. Please consult a financial advisor or your banker.

An example of CTOS credit report for a property developer available for purchase

Sample summary page of credit report for Test Case Sdn Bhd showing proprietary CTOS Score

A Case Study Of Digital Marketing In The New Normal

I responded to a Facebook ad for Quill Residences, a KL New Projects property at Jalan Sultan Ismail with 500+ apartments and was invited to a “one on one” Zoom session with a Team Leader, J to discuss the project's USPs as an investment property. Quill Residences (tag “City living at its finest”) is expected to be completed in late 2022.

During the 25 minutes “one on one' Zoom online session, J shared the following with me :

a spreadsheet showing projections of rental income from a 700+ SF unit,

the project's USPs,

the developer 's background and original development plans,

the availability of a furnishings package (the Quill Residences units are partially furnished) and

the services of an Airbnb hosting service operator to rent out fully furnished units on behalf of owners.

J said he was a former engineer before joining the real estate agency business. I think J’s online presentation was professional, he also offered to speak in Mandarin or English.

Unlike many agents, I felt J was able to answer most of my questions. J promised he would follow up on any of my questions he did not have answers to. To his own and his company’s credit, he did.

For example, I asked if J could get me a credit report on the developer (a subsidiary of the Quill group which has interests in retail, interior design, property etc) and a hotel sector report (Quill Residences' most likely competition is from the Platinum Face Suites & Hotel down the road at Jalan Sultan Ismail )

Post Script and Disclaimer

Is the property sector in Malaysia facing a similar crisis like China's? For a excellent background to how the property overhang problem developed, see Carmelo Ferlito's paper “Housing Forward: From Housing Crisis To Housing Stability “. A YouTube summary is available here.

iproperty.com has a good guide by Ikhram Merican on buying off plan property from developers, “5 Things that can go wrong when buying a house from a developer & how to avoid them”.

See also my 360 KLCC posts :

FTHBs should buy New Projects OR Sub-Sale Properties?

“Bull Or Bear Property Market?”

"Is now the right time to buy property?"

“KLCC Luxury Condos NOW cheaper than Penang Mass Market Flats?”