Are KLCC Rentals Really Recovering?

Knight Frank Malaysia’s Real Estate Highlights 1H 2022

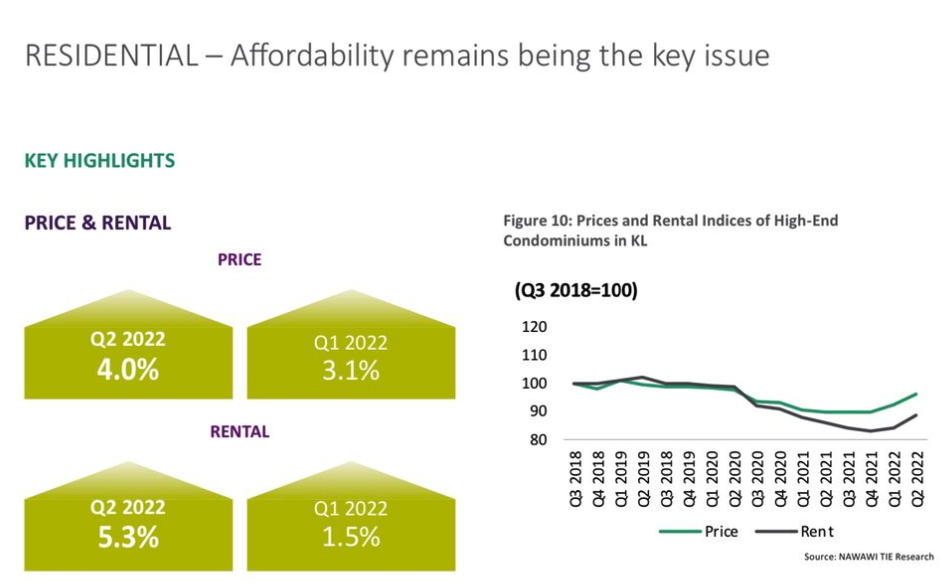

Knight Frank Malaysia is projecting an uptick in the rentals market of high end condominiums in KL just like Nawawi Tie Research. The research team at KF says cost-push inflation will push average rental prices of high end condominiums in KL higher. See figure below.

When I saw the emphasis in the word, ‘Increase’ in KF's infographic “Property and rental prices are expected to increase for high end condominiums in KL, I was happy as a bee for a while.

Until upon on closer examination I saw for KL City the expected increase was just RMO.015 psf. So for example, for a 2000 sf unit in KL City, rentals will be up by around RM30 pm according to KF. Folks, that’s not even enough to pay for a celebratory lunch at Ben’s at KLCC Suria. To come down to brass tacks, I simply don't think a RM0.015 PSF increase is enough to signpost a nascent recovery in the KLCC rentals market.

In a recent post at my blog 360 KLCC I reviewed PropertyGuru’s novel interactive Property Asking Rental Index in its Q3 2022 Malaysia Property Market Report. The use of an interactive line chart gets a thumbs up from this tech geek. But as a former professional stock picker aka investment I prefer to rely on actual rentals PSF instead of asking rentals PSF. (In my blog 360 KLCC, I am an enthusiastic user of PropertyGuru's Pricing Insights charts which are based I think but cannot be 100 % sure on actual property transactions prices and rentals in PSF)

I pointed two reasons why I am not so sanguine about a recovery in KLCC rentals in 2023.

1. the negative blowback over new MM2H rules (see “Latest MM2H figures prove the new rules are leading to a big loss for Malaysia”) .

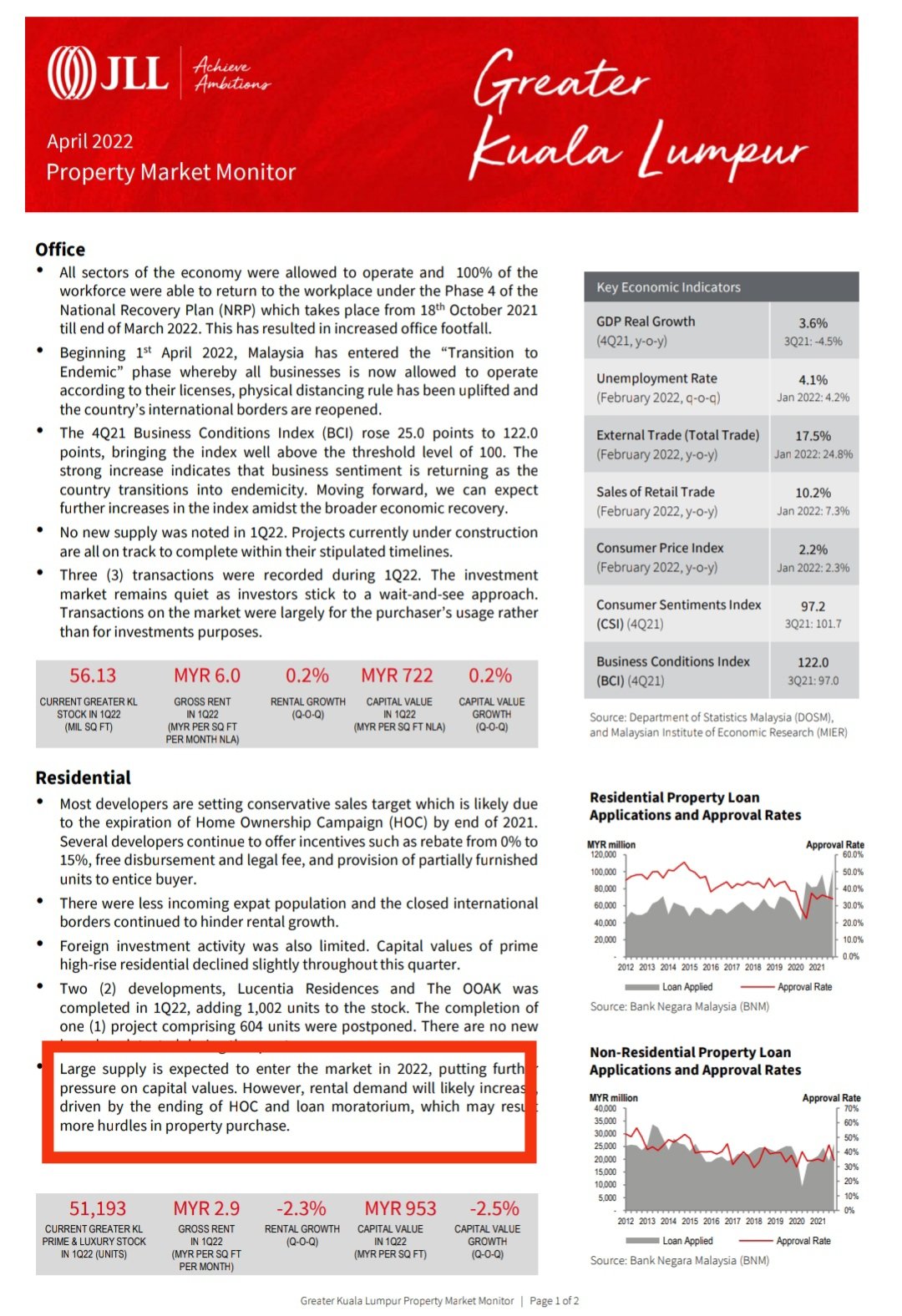

2. a sharp increase in supply of properties deferred by the MCO in the KL city centre (more than 7500 units in 2023 compared to just 3200 units this year) according to those nice folks at Nawawi Tie Research and JLL.

Approximately 1000+ units out of the 7500 forecast for 2023 are from 8 Conlay's two towers. But recent reports by EdgeProp the main contractor for 8 Conlay's RM5.4bn mixed use development in the heart of KL has stopped work will have raised questions whether the original 2023 delivery targets can be achieved. I am trying to get an update from 8 Conlay's developer KSK Land's corporate communications department if the projected 2023 delivery dates for its Towers A and B are still on track.

#knightfrank #klccforrent # #realestate #realestateagents #propertygurudatasense

Copyright by Nawawi Tie Research

Copyright by JLL