“Is The Residential Property Market Really Recovering?” Part 2/3

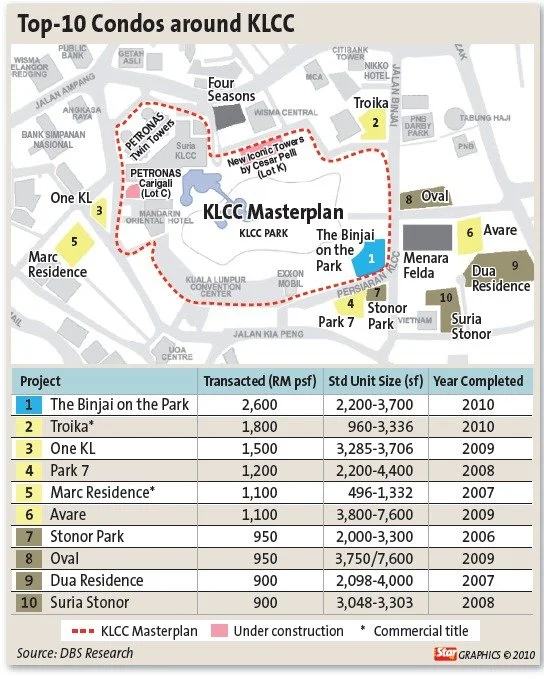

Did The Star’s 2010 Top 10 KLCC condos beat inflation?

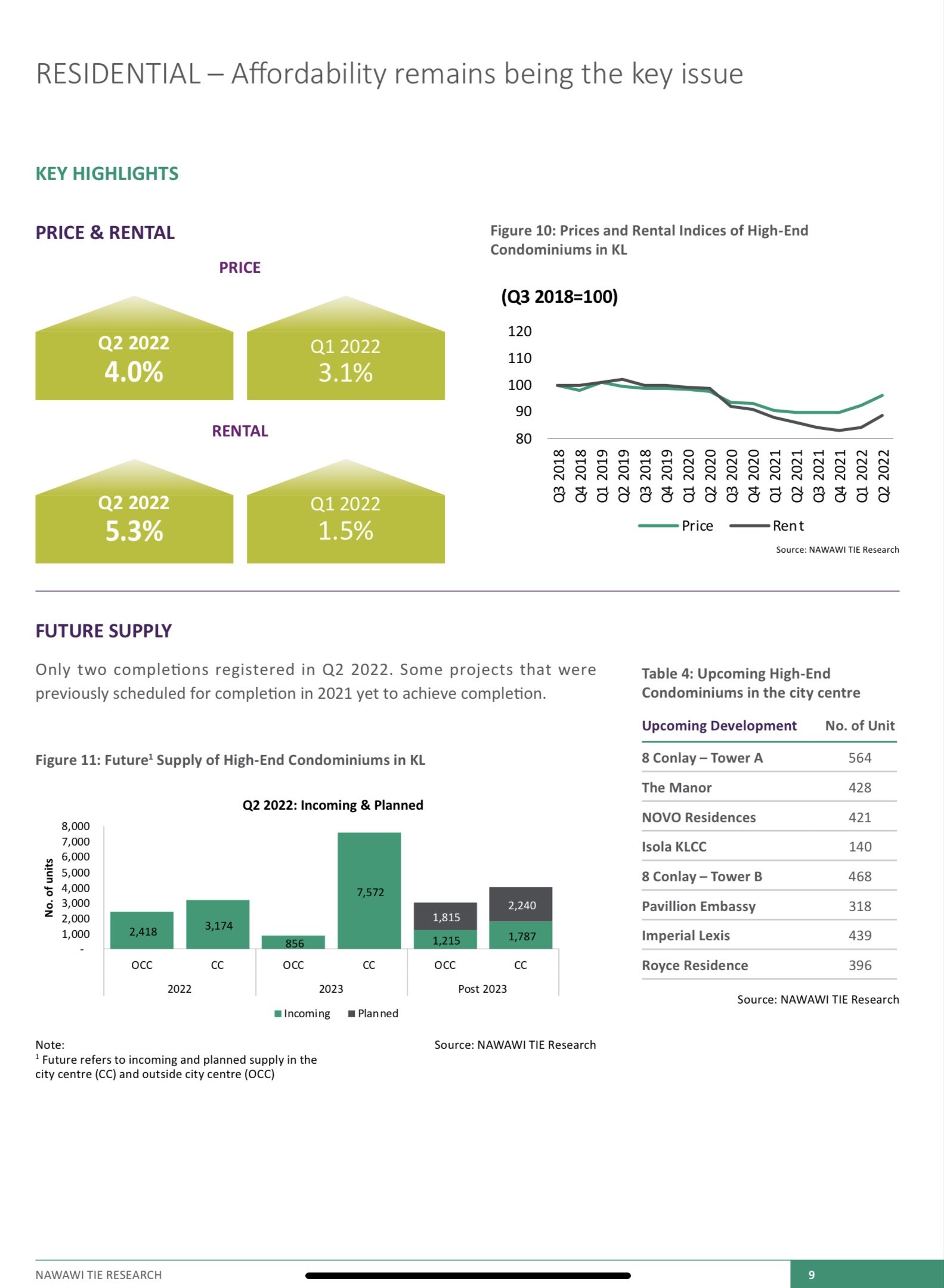

Industry pundits say the KL high end property market is recovering . For example Nawawi Tie’s 2Q 2022 report says asking transactions prices and rentals are up 4% and 5.3% YoY for high end KL condominiums (see figure below). That’s indeed good news for the industry. But there is a fly in the ointment about the good news.

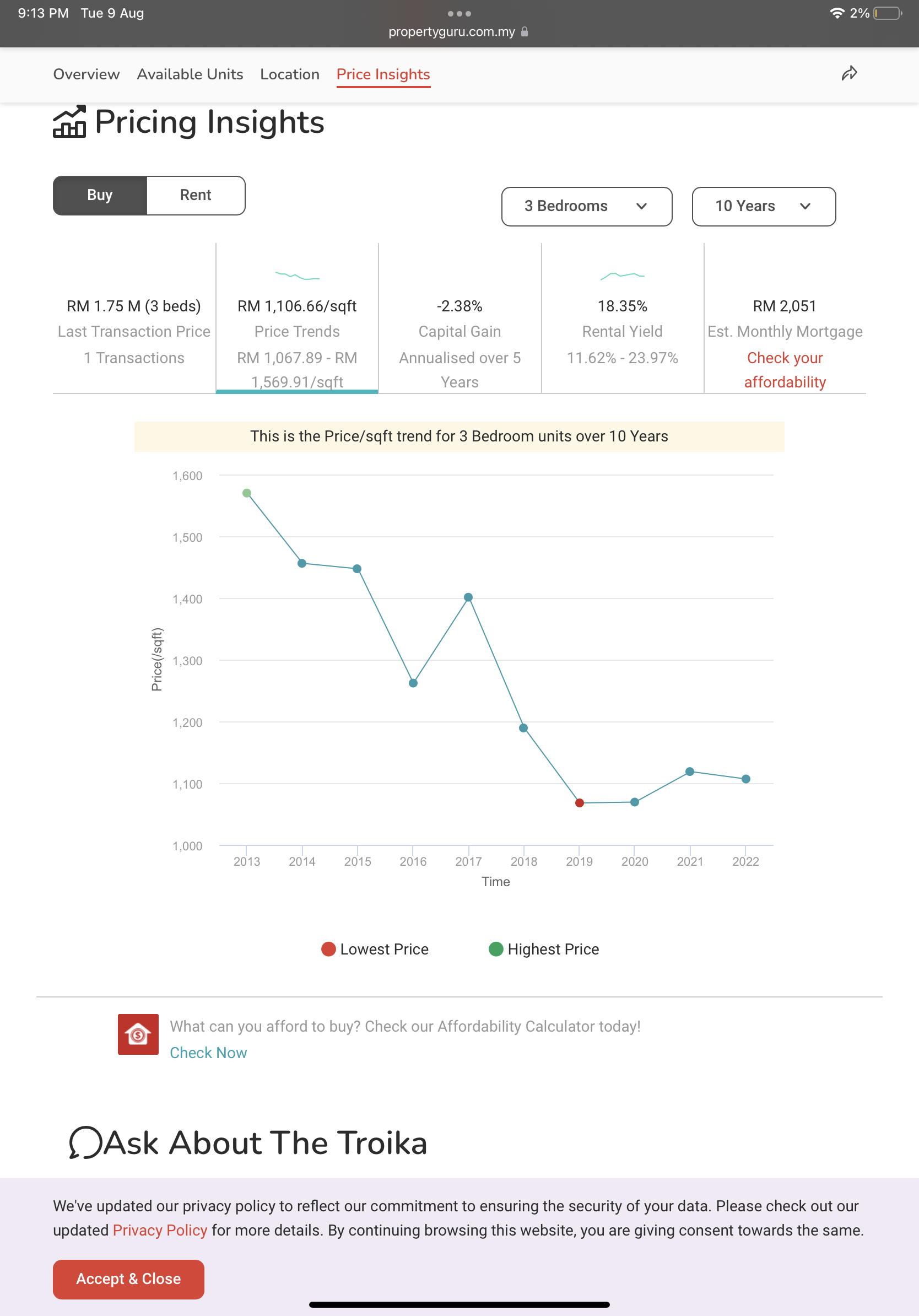

Asking transaction and rental prices don’t ALWAYS correlate to actual buying interest or actual rentals in the future. That’s why I (and professional stock pickers aka investment analysts) prefer to judge evidence for a recovery from actual transaction prices and rentals in psf .

Unlike Nawawi Tie, I am not so sanguine about the prospects of a bounce back in the high end KL property market. The evidence from 2022 KL high end condominium auctions is telling me a different story. Many 5* KLCC Luxury Condominiums have no bids at their second or third auction outings. To me this suggests a lack of buying interest by high end property investors. And some auction property prices have now reached below RM500 psf. My auction agent J sent me via WhatsApp notices of two upcoming auctions at The Capsquare Residences and the Cendana which fall below RM500 psf.

Perhaps you might think these two auctions at the Cendana and the Capsquare Residences are outliers. Perhaps you might think they don’t really reflect the picture for the broader KL high end condominium property market?

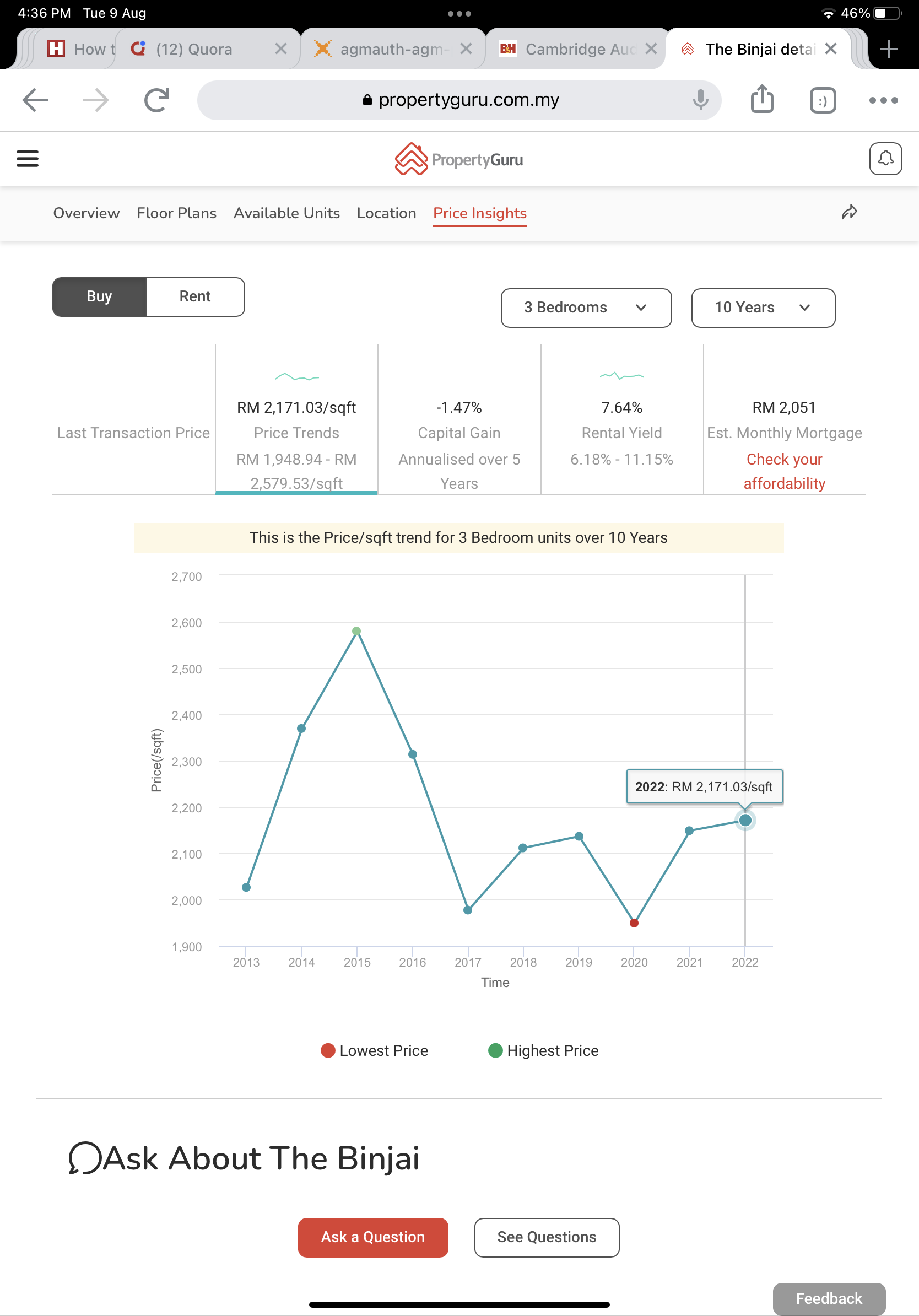

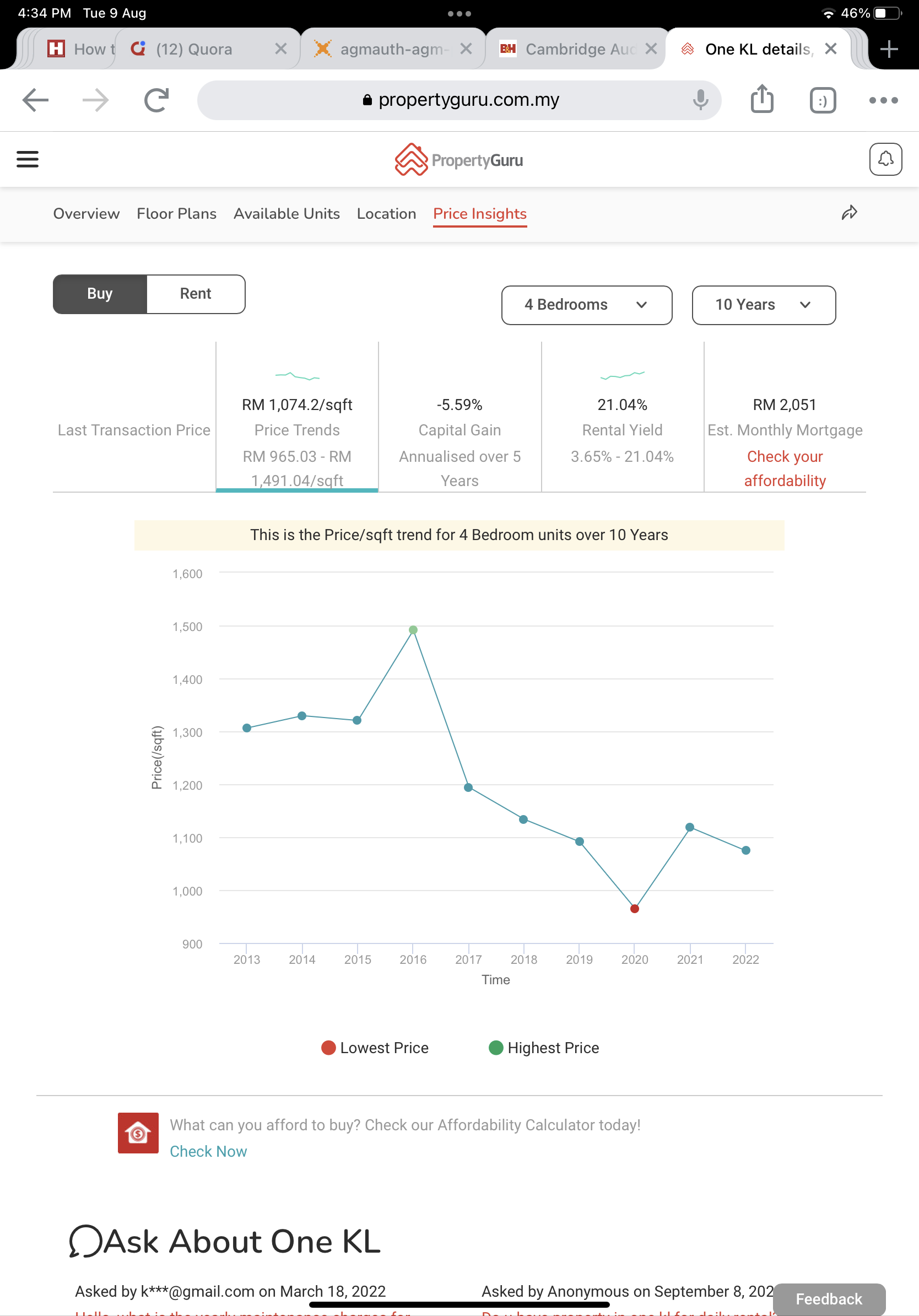

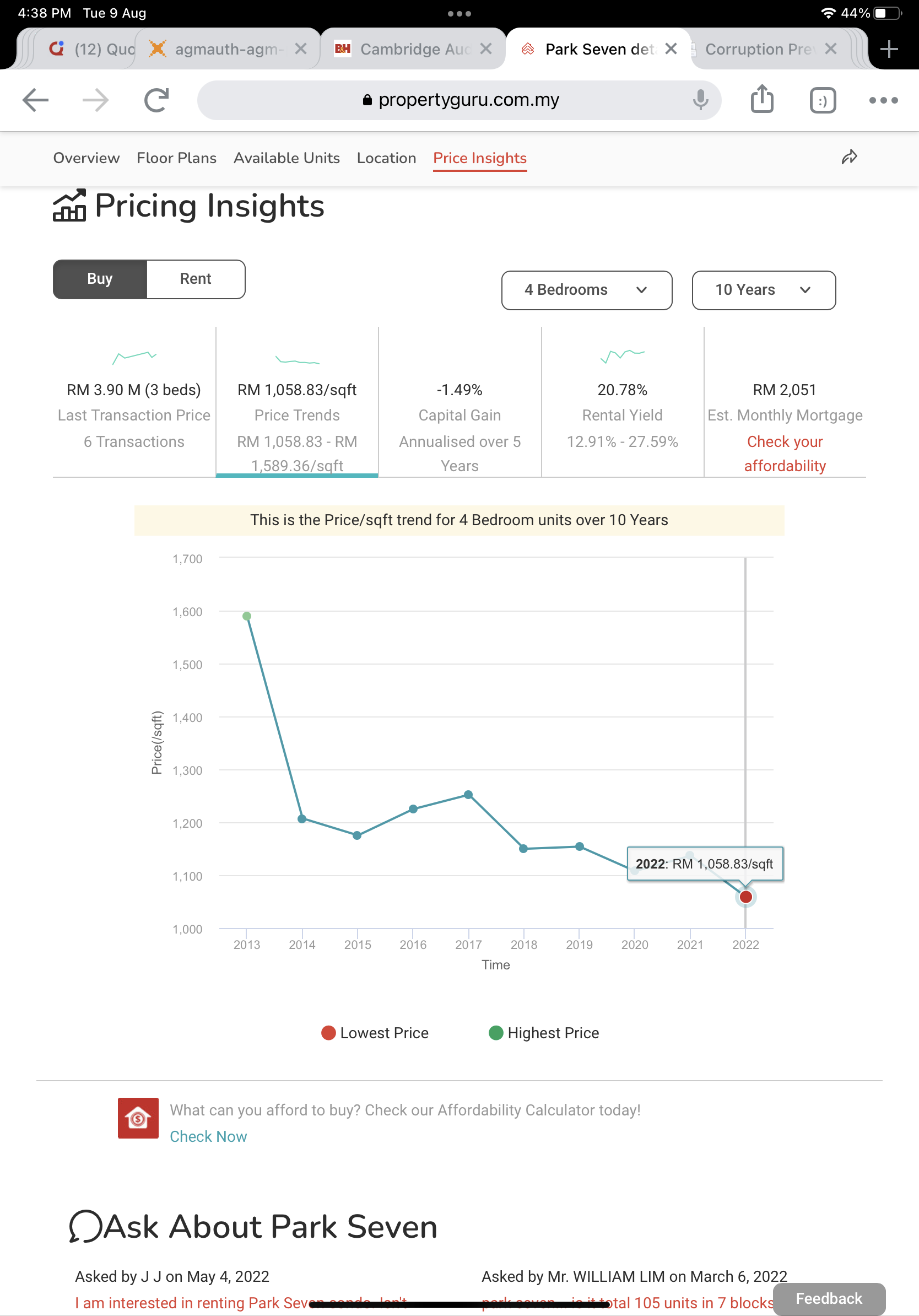

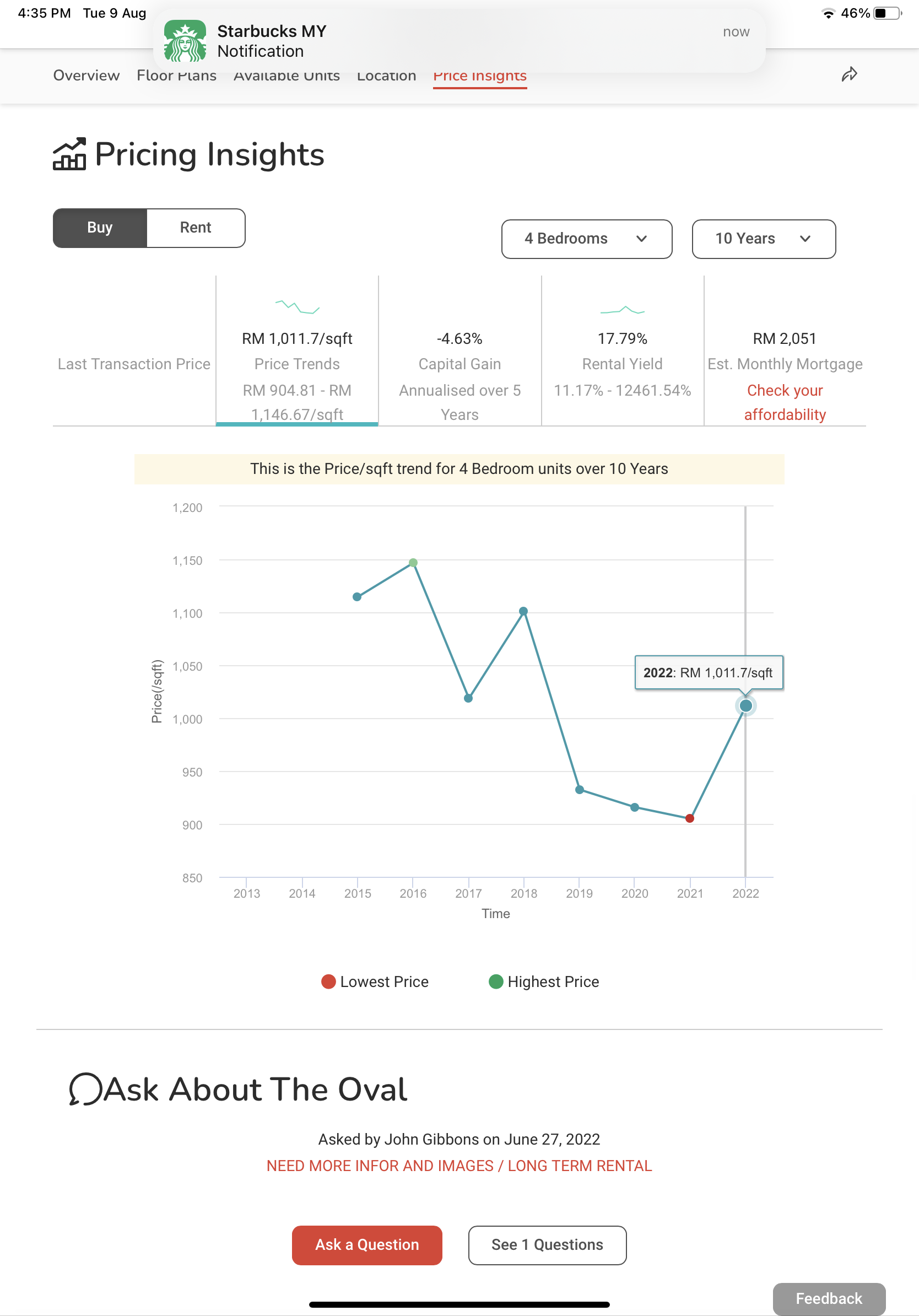

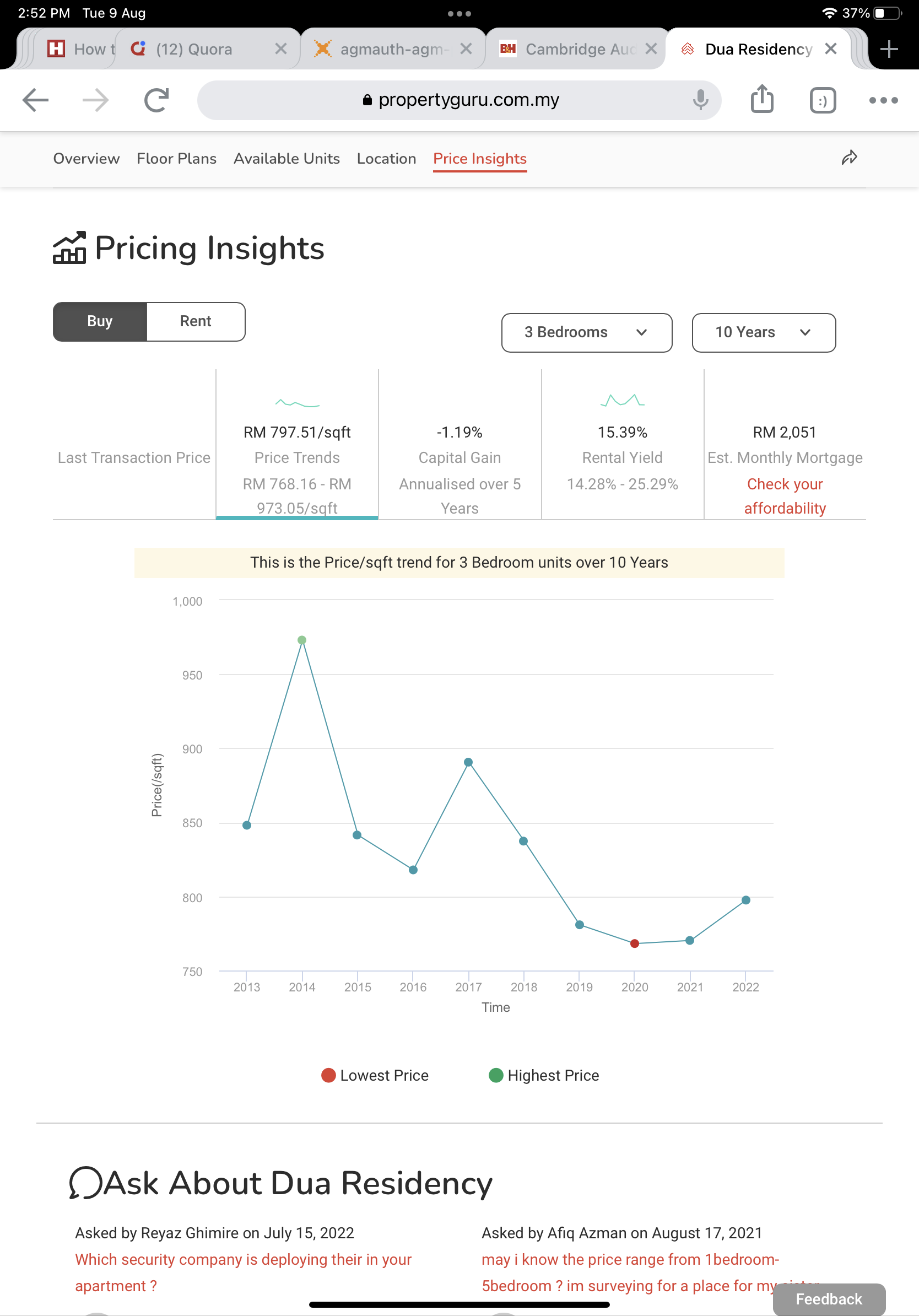

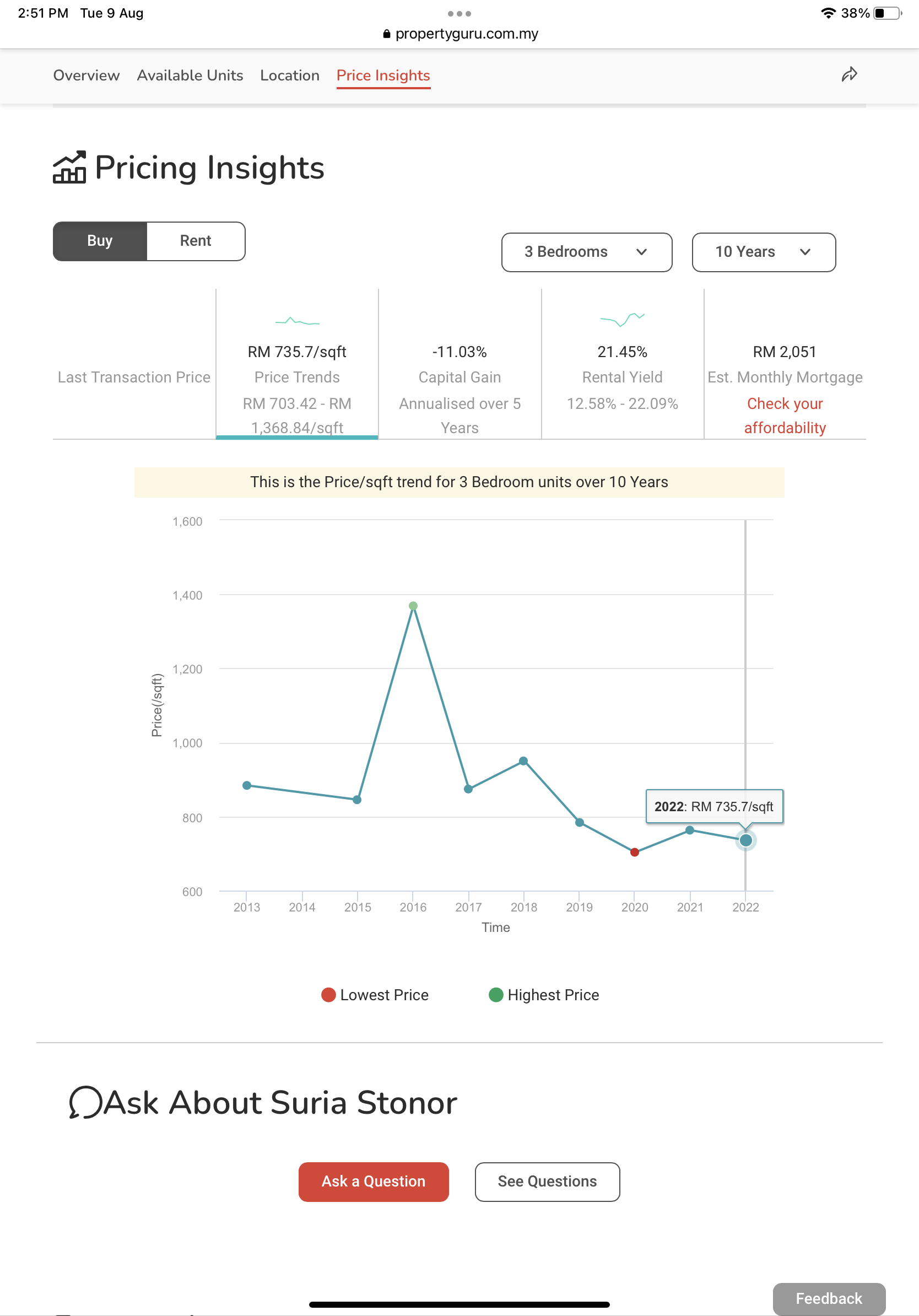

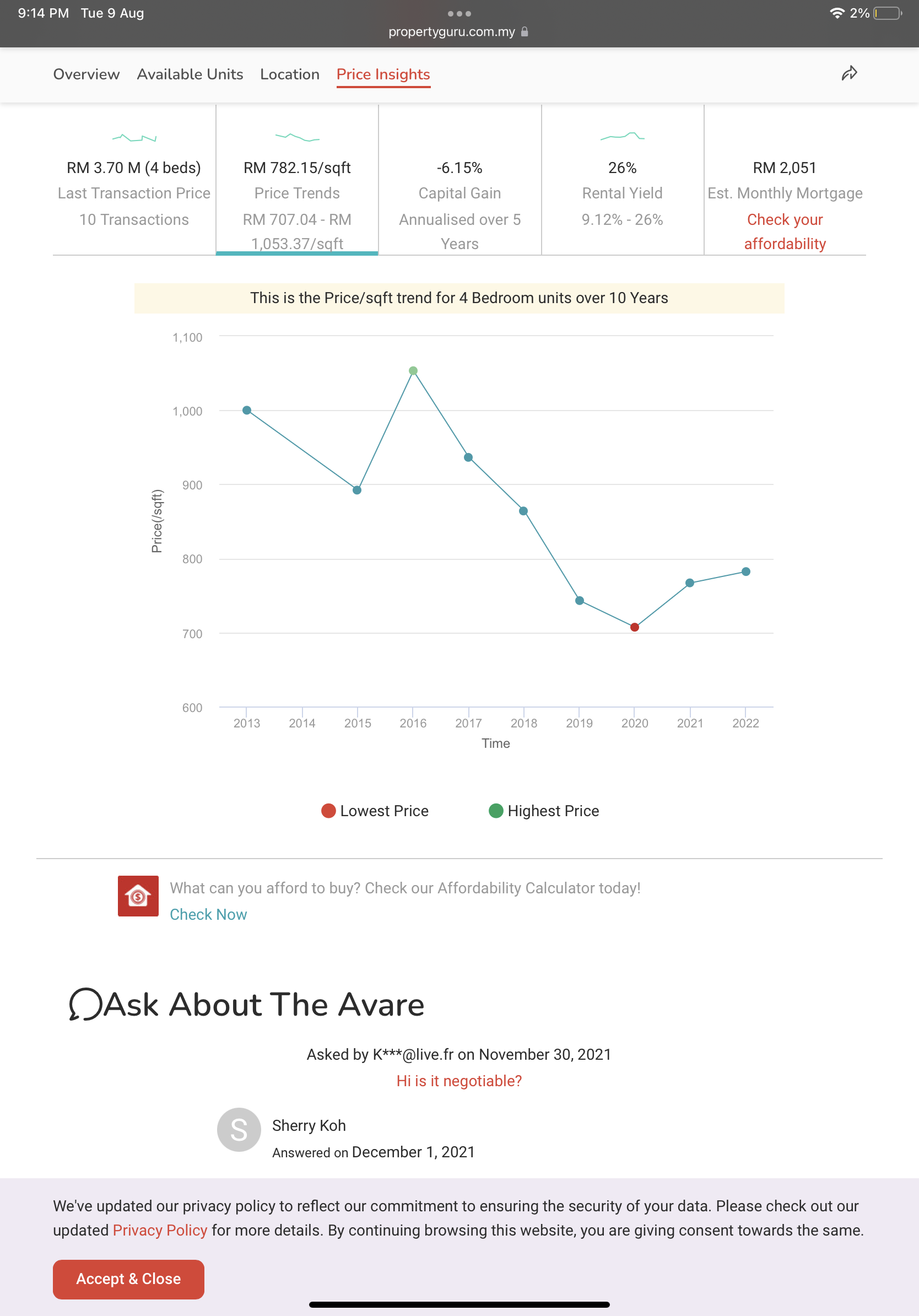

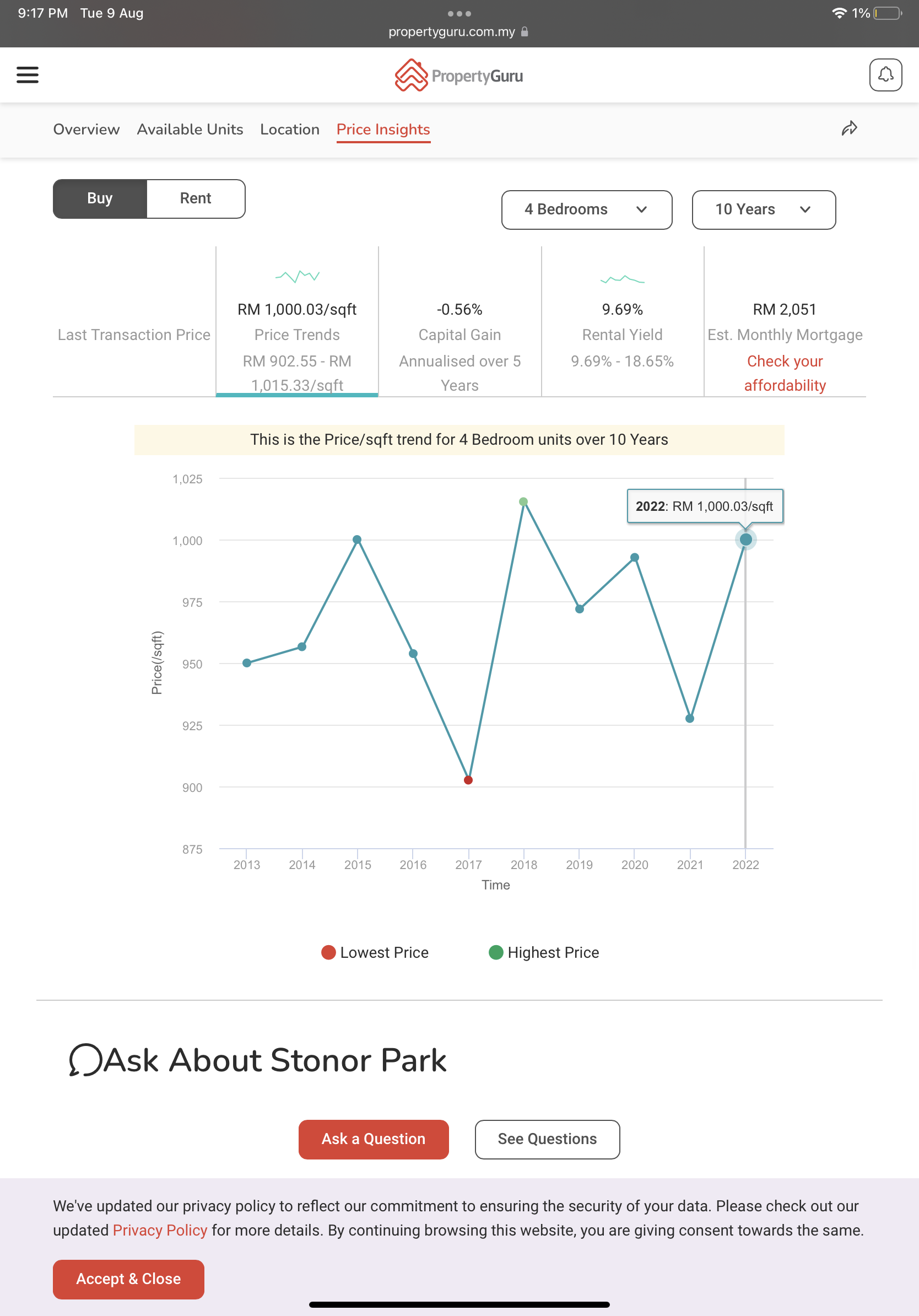

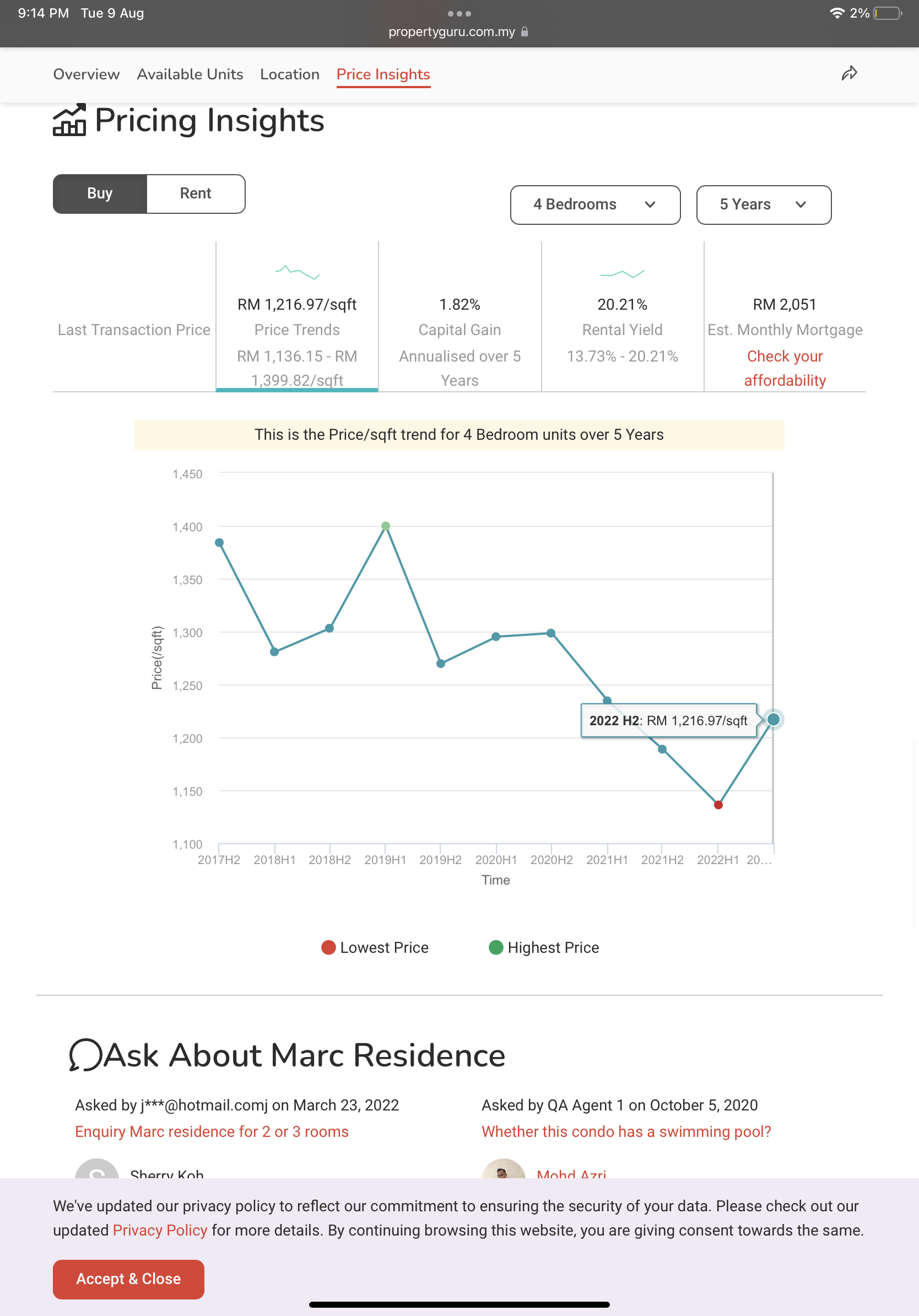

Take a look at the property transaction prices in psf for the Star newspaper’s top 10 condominiums around KLCC Park in 2010. Then take another look at the 2022 transactions prices in psf of the same condominiums in the Slide charts below.,

Most of the property transaction prices charts for the Top 10 KLCC condominiums in 2010 show a DECLINE in transaction prices in PSF over the past 10 years. Instead of inflation beating capital appreciation, most owners of The Star's Top 10 KLCC Condo list actually saw the opposite, ie their property transaction prices in PSF fell over the course of 10 years.

Suria Stonor . See “KL auction property market update #3 - Suria Stonor 3283sf @RM609 psf”

And now you know most freehold KL 5* Luxury Condos are not inflation hedging assets. Rina Zaabar, a PEA and team leader, showed me the Ritz-Carlton penthouses actually showed price appreciation in PSF. However the smaller units at Ritz-Carlton did not perform as well as the high floor penthouses. I think but cannot be 100% sure buyers are happy to pay a premium for good views of the KLCC iconic Twin Towers and KLCC Park.

If there are other KLCC area specialists or Branded Residences specialists out there who can find me another example of a KL 5* luxury condominium or Branded Residences that have beaten inflation over the past 5-10 years please contact me. I will be happy to put your name in the Raymond Chong Hall of Fame of Outstanding Real Estate Professionals.

Post Scrip & Disclaimer

Nawawi Tie’s 2Q 2022 KL property update can be downloaded below (double click the cover photo below)

I am not a registered real estate agent with the BOVEA. If you are thinking of buying a property in Malaysia you should consult a valuer or real estate agent registered with the BOVEA.

My last IA licence in another jurisdiction expired circa 2001. The information in this post is based on reports in the public domain and do not constitute investment advice.

This post is my 110th and marks the one year anniversary of the launch of my KL high end property market blog -360 KLCC.

Please check out my other blogs :

Real estate marketing 101 - a blog aimed at newbie professionals in real estate

Cooking 4 Seniors - a blog aimed at seniors showcasing simple easy to cook meals using family recipes and from online sources

Tech 4 Seniors - a blog that charts my 40 year journey as an audiophile and my interest in home automation

Seascapes and Coffee - a blog about photography and cafe culture

Heritage houses and hotels - houses and hotels in the heritage quarter of Georgetown (NEW)

Waterfront View - a blog on Seafront properties in Malaysia (Work In Progress). I previously covered the topic of evaluating seafront investment properties at my blog 360 KLCC.

Screenshots of my other blogs 🖕