Get ready the popcorn: KLCC Property Sale in 2022?

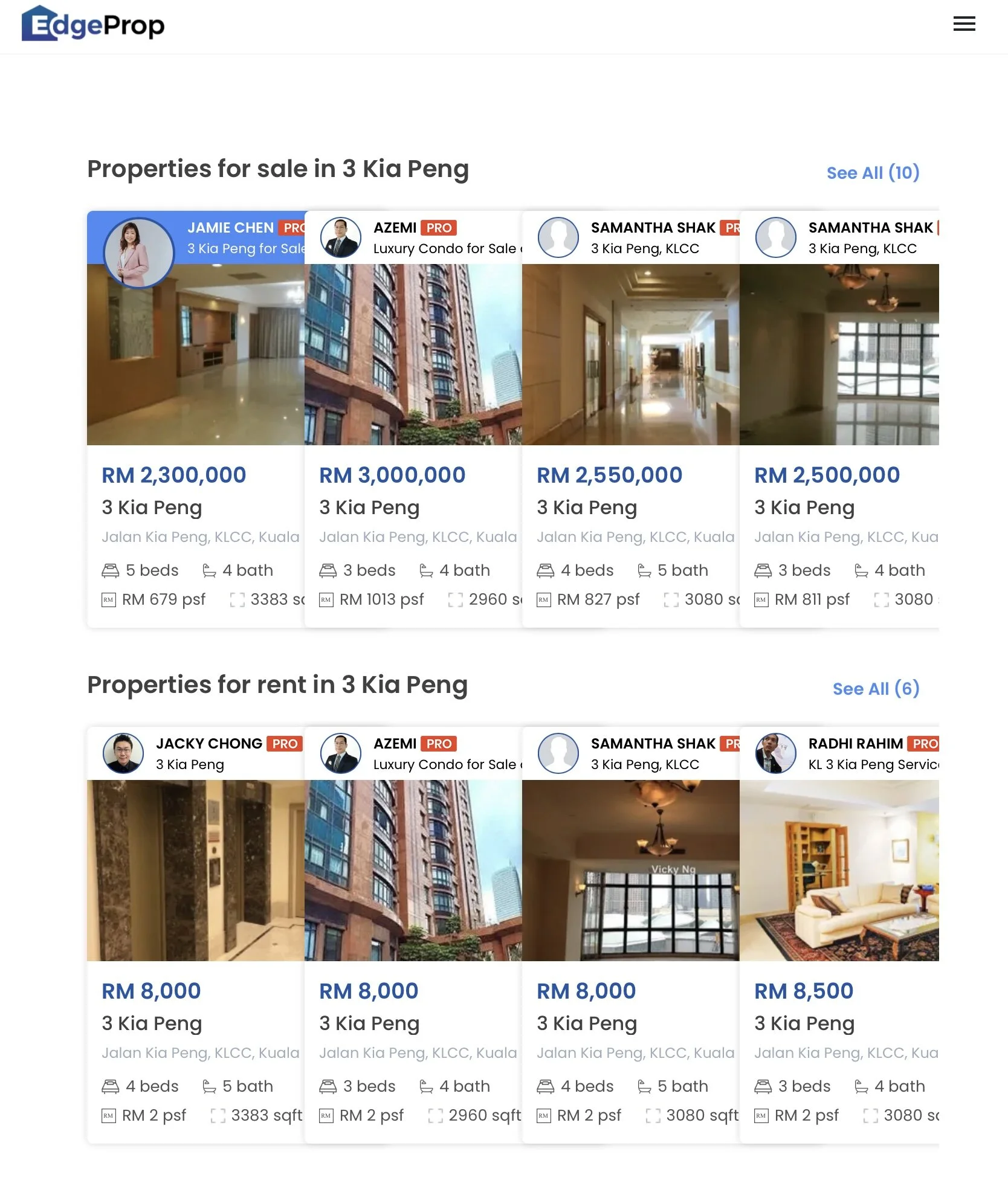

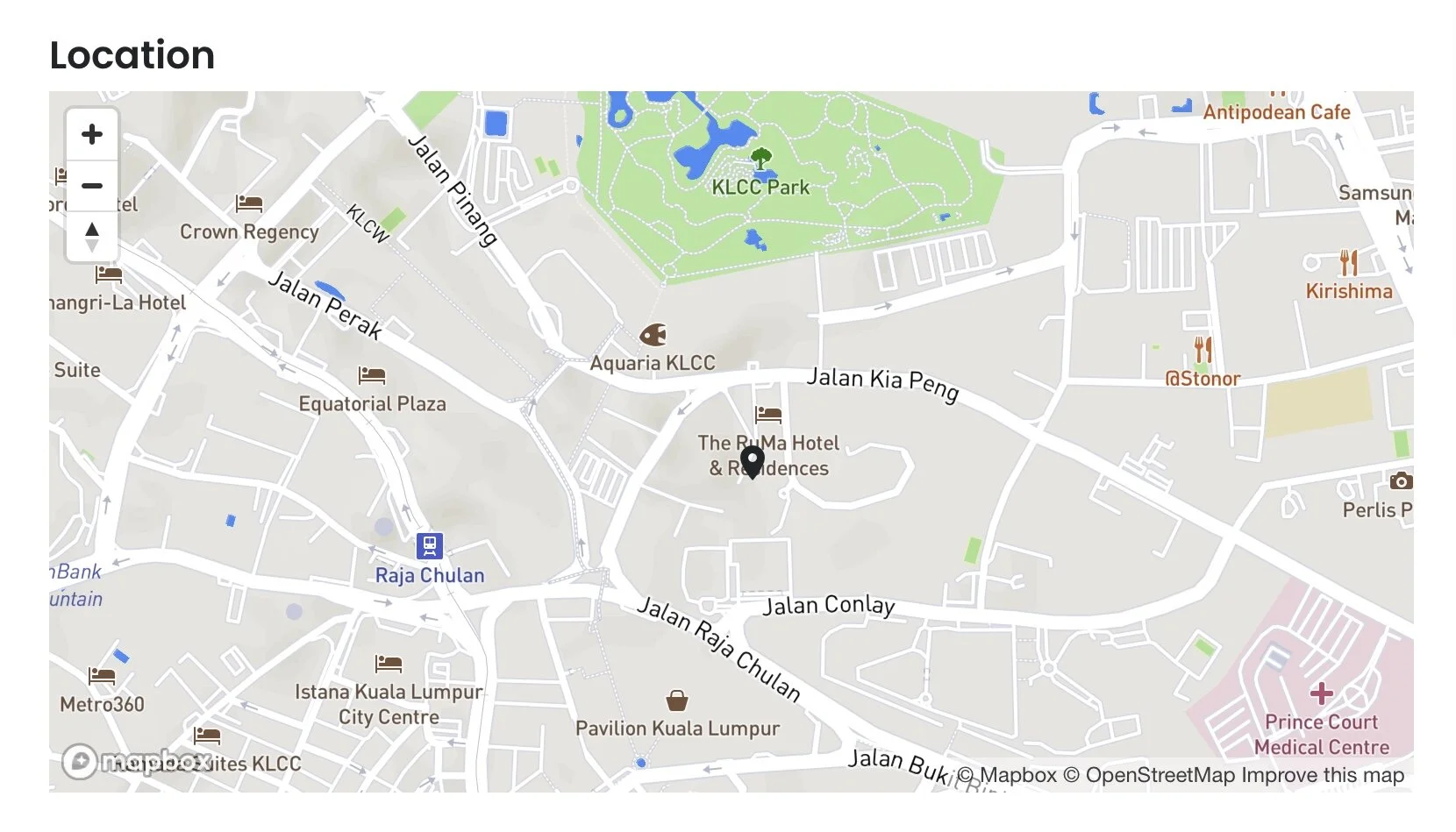

Yesterday, I was bored after writing my post about the 1st month’s anniversary milestone for my high end property blog, 360 KLCC. On a whim, I checked my Whatsapp folder to see if there was anything interesting. Wowza! A KL agent I contacted previously about a KLCC property just posted a listing for a KLCC SUPER CONDOMINIUM priced at RM680 PSF. Was I interested in taking a further look? So I took the bait, hook, line and sinker. The agent’s posting was for a freehold 3300sf 3 Kia Peng unit, put up just hours ago. Now I was in the market for a 3 Kia Peng unit back in 1999/2000 when the list price psf was around RM520-550. So was this 3300sf unit a bargain at RM2.3m? Or maybe prices of 5* KLCC condominiums will drop even further in 2022.

I think I’ll just sit back, get out the popcorn and watch the show, “The Great KLCC Property sell off? Coming to you in 2022…”

Picture credit: GR Stocks, Unsplash

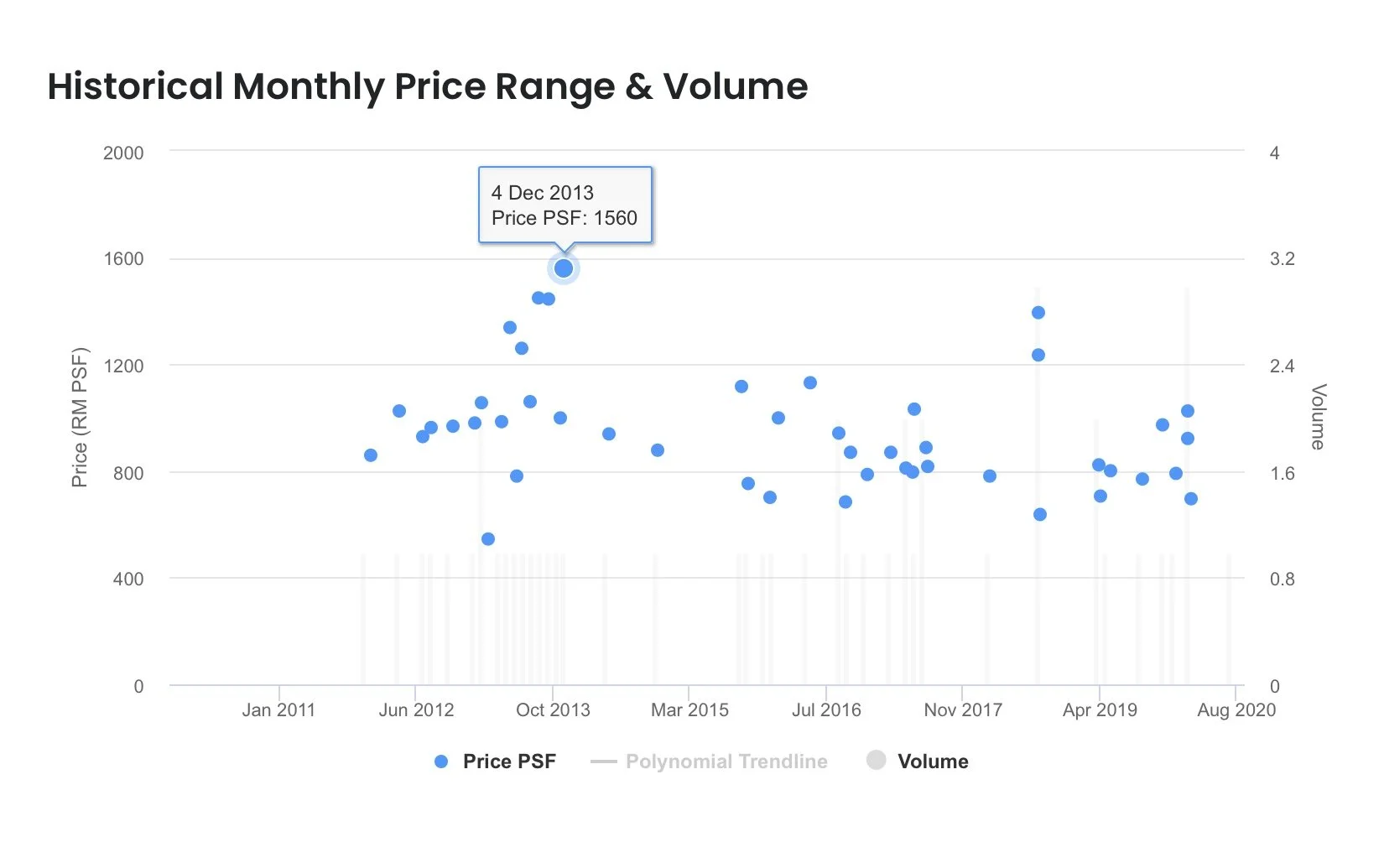

Assuming a buyer was able to get 3 Kia Peng for RM500 psf in 2000 then, and inflation was 3% per annum over the period 2000-2020, so RM500 psf in 2000 should be roughly equivalent to RM800 psf in 2020 (i.e. assuming no REAL capital gain) In other words, at RM680 psf, this 3 Kia Peng unit listed just yesterday was cheaper by RM120 psf compared to the RM800 psf projected assuming no real capital gain. A bargain, you think? Maybe. Unless prices drop even further.

I asked around and found there are at least two other KLCC SUPER CONDOMINIUMS on my list that have reportedly seen price transactions in PSF that are lower than their adjusted for inflation launch prices. I think it will be interesting to check out all the other KLCC SUPER CONDOMINIUMS on my list to see if their current asking prices are below their inflation adjusted launch prices.

Maybe I’ll do that in another blog post.

Of course using CPI as a stand in for inflation is a crude measure because many items in the basket of goods used in the CPI calculations are controlled price items. A better way is to adjust prices in PSF using the GDP deflator. How to adjust housing property prices using the GDP deflator is out of the scope of this blog. You can Google “Malaysia GDP deflator 2000-2020” and make your own adjustment for launch prices in 2021 nominal terms if you have time and inclination to do so.

Notes and disclaimer :

1.There was another 3 Kia Peng listing going for RM811 PSF.

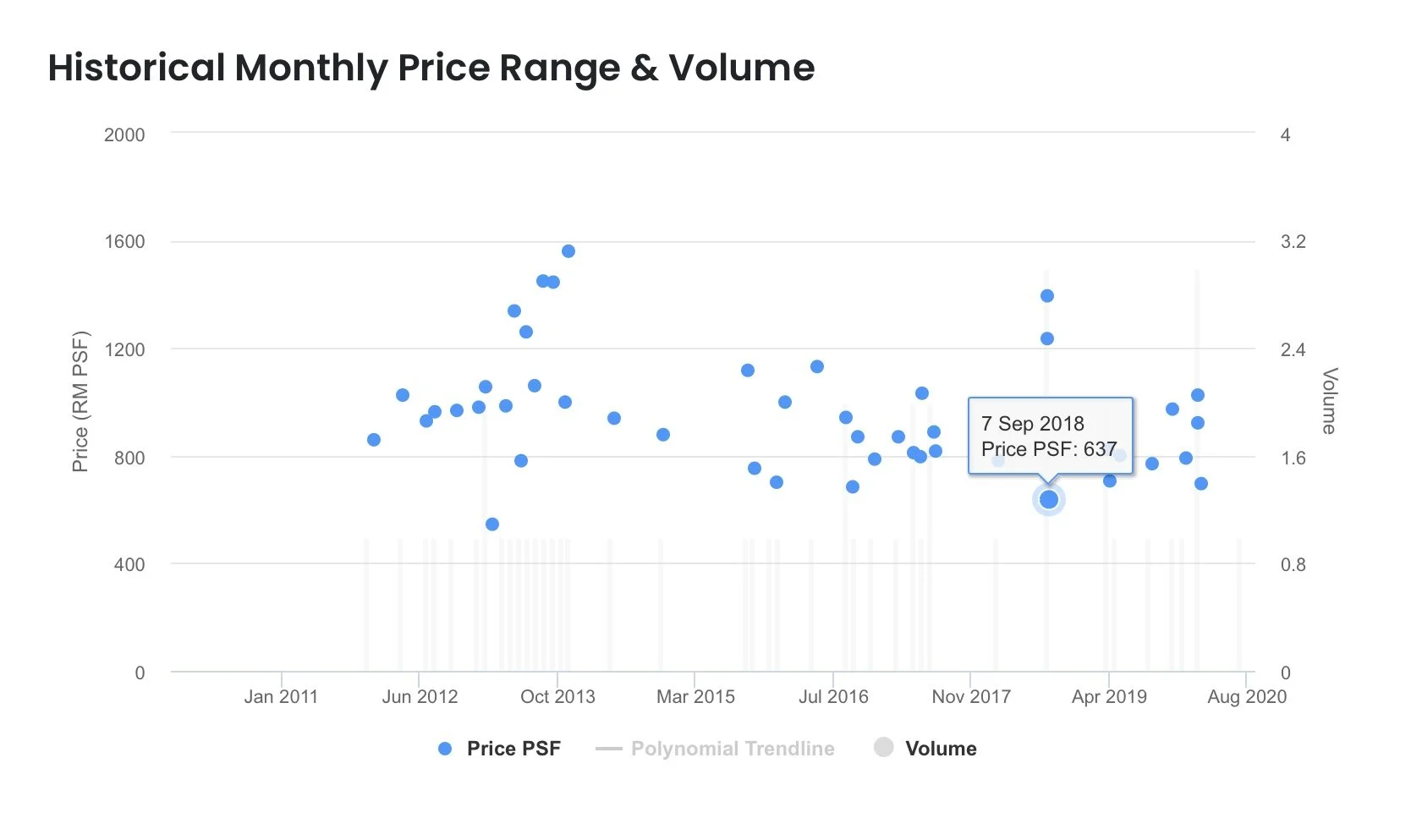

2. The median price PSF for 3 Kia Peng according to EdgeProp Analytics was RM820 PSF as at 10 September 2021) .

3. I am not an investment advisor registered with the SFC in Malaysia. My previous investment advisor’s licence in another jurisdiction expired circa 2001. You should consult a BOVEA registered valuer or real estate agent if you are considering buying a property.

Copyright by Veritas Studio 2021

Back in 1999 (this was just right after the Asian Financial Crisis of 1998) , I started looking around to buy an investment property in KL. At that time, there were only 3 new luxury freehold condominiums around KLCC - 3 Kia Peng, Kondominium Kirana (now rebranded as Kirana Residence) and Hampshire Park.

Of course, Desa Kudalari and Menara Pinang were around then but the former was about 15 years old in 2000 and I was not interested in buying an old condominium. Menara Pinang comprised serviced residences for rent, but not for sale - I think its still privately held, so Menara Pinang could be an excellent en bloc investment.

Of the 3 luxury class condominiums, I immediately ruled out Hampshire Park - it was further away from KLCC Park and the tower blocks did not have grand ground floor reception lobbies. In my book, a KLCC condominium must have a grand ground floor lobby, otherwise I downgrade it automatically to 4* . See my list of 5* SUPER KLCC CONDOMINIUMS here.

Of the other two, I preferred 3 Kia Peng. But when I came back to KL in early 2000 , this time to make an offer in writing to the developers (as a savvy investor, I knew that when times are bad, you get a better deal going direct to the developer). I asked for a 15% discount from both.

3 Kia Peng offered kindly to knock off 5% from their list price. But Kondominim Kirana said I could buy one of the leftover units for 10% off. And in a nutshell, that is how I came to be an owner of a unit in Kirana Residence.

All pictures copyright EdgeProp