The most realistic 2022 Property Market Outlook for KL properties

Some interesting insights from the Knight Frank Asia Pacific Outlook Report for 2022 . https://lnkd.in/gqNQgxDA

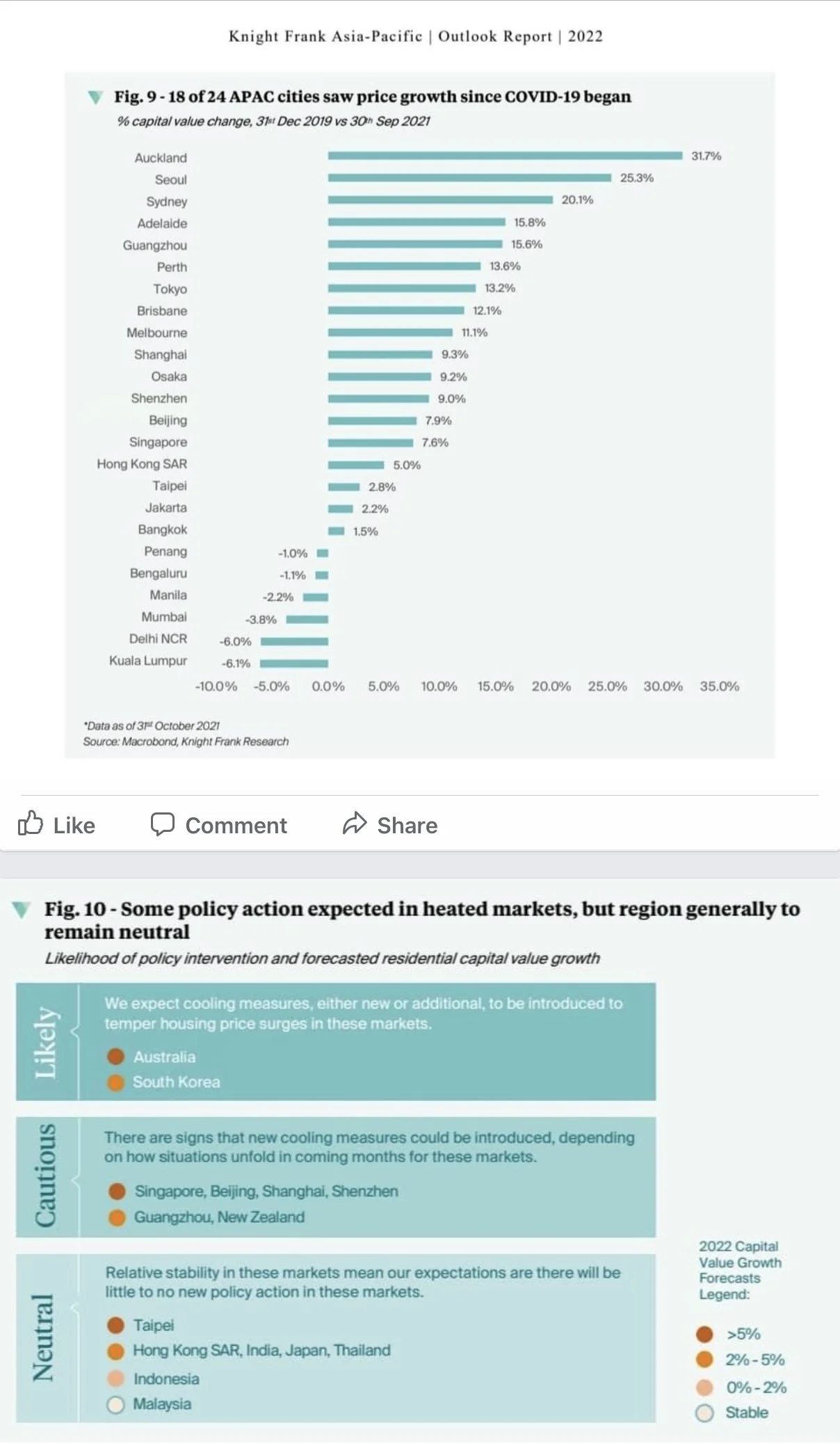

On page 10, there is an interesting table (Fig 9) that shows the 2021 performance of the 24 Asia Pacific cities covered by KF. 18 recorded price increases. No surprises here, but KL was the WORST performer (-6.1%) while Sydney (+20%) and Auckland (+32%) topped the list of best performing property markets.

Regarding prospects for property markets in 2022, KF is still cautiously optimistic for Australia, Singapore and Taiwan (+5% growth each). But despite its lacklustre performance this year, KF doesn't expect a rebound in property prices for KL in 2022. KL is the ONLY city that KF thinks will see 0% growth, the others are expected to register at least 0-2% growth.

RC’s take on the above Property Market Outlook 2022 by KF:

I agree with KF that it’s probably too soon to call an uptick in sentiment towards the high end property market in KL. Yes, the latest survey from PropertyGuru has noted some property sellers have increased asking prices in 5 states. But KLCC property auctions have also picked up pace. I even see several branded serviced residences are now on the auction block. https://360kiranaresidence.com/klcc-property-news/v38jaj1szk759jo5v52qde8ocp8r06

At the other end of the market, the owners of mass residential leasehold properties like Ryan & Miho in Section 13, PJ that received their keys this year are I think still posting unrealistic asking prices for rent and for sale. Take a look at “for rent” listings on PropertyGuru or 3* Ryan & Miho in Section 13 v 5* Platinum Suites in KLCC below. Which would you pick?

With rents at prime KLCC properties down by 30-40% since 2018, I think there will be downward corrections in asking prices for new mass residential properties at PJ Section 13 that are coming onto the property market in 2022.

So, dear reader, do YOU think the Year of the Tiger will see a rebound in property sentiment?

To Be Continued